Zurich Malaysia Partners With GXBank To Launch Anti-Scam & Fraud Insurance

This new product aims to protect Malaysians from financial losses resulting from unauthorised electronic transactions.

Expanding on their bancassurance partnership initiated in May 2024, Zurich General Insurance Malaysia Berhad and GXBank Berhad have introduced Cyber Fraud Protect

This new digital insurance product is available through the GXBank app and powered by the Zurich Edge platform.

This innovative solution is designed to offer protection and peace of mind in an increasingly digital world, where online transactions are becoming the norm. By addressing the growing concern of unauthorised access to financial accounts, this product aims to provide Malaysians with a secure way to protect their finances against potential scams.

According to the Federal Commercial Crime Investigation Department, Malaysians lost a staggering RM1.6 billion to online scams over 19 months

As digitalisation continues to reshape how we manage our finances and make purchases, the threat of online scams has surged, creating significant challenges for consumers and society alike.

Cyber Fraud Protect responds to these challenges by offering protection against financial losses caused by unauthorised electronic transfers, whether from local bank accounts, ewallets, credit cards, or debit cards. This ensures vital security in an era of increasing cyber threats.

Zurich Malaysia and GXBank shared some insight during the launch of the new protection plan

From lefto to right: GXBank chief executive officer Pei-Si Lai and Zurich Malaysia country chief executive officer Junior Cho.

Image via Zurich Malaysia (Provided to SAYS)"Since our partnership began in May, we've collaborated closely with GXBank, leveraging Zurich's risk management expertise and digital capability to launch Cyber Fraud Protect — an innovative online insurance solution for Malaysians," said Zurich Malaysia country chief executive officer Junior Cho.

"Cyber Fraud Protect embodies our brand promise, 'Care For What Matters,' by delivering essential security in an increasingly digital world. We're confident it will offer Malaysians the robust protection they need in today's fast-changing digital landscape.

"In designing and launching this product, our primary focus was ensuring a smooth, positive customer experience, and with the Zurich Edge platform, we have been able to do just that, delivering a seamless and convenient in-app purchasing journey for GXBank customers," he added.

Meanwhile, GXBank chief executive officer Pei-Si Lai said the company has been constantly working to provide the best digital banking experience while ensuring the financial literacy, accessibility, and safety of Malaysians.

"Co-creating Cyber Fraud Protect with Zurich, this product is unique and one-of-a-kind. It not only offers the highest coverage protection of up to RM20,000 against losses due to unauthorised transactions from cybercrimes, but also the widest coverage for all local bank accounts, debit or credit cards, and e-wallets beyond GXBank’s ecosystem," she added.

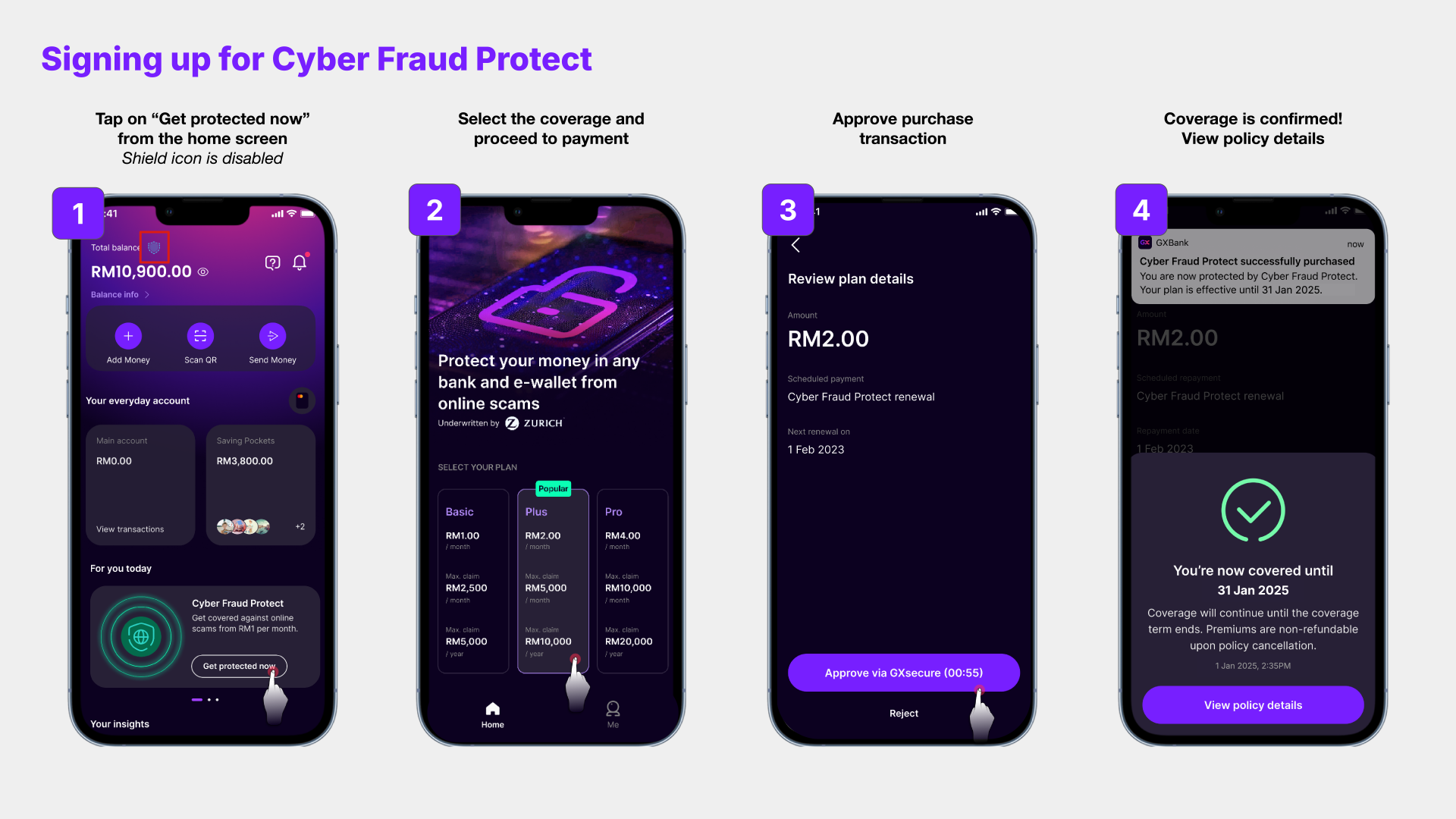

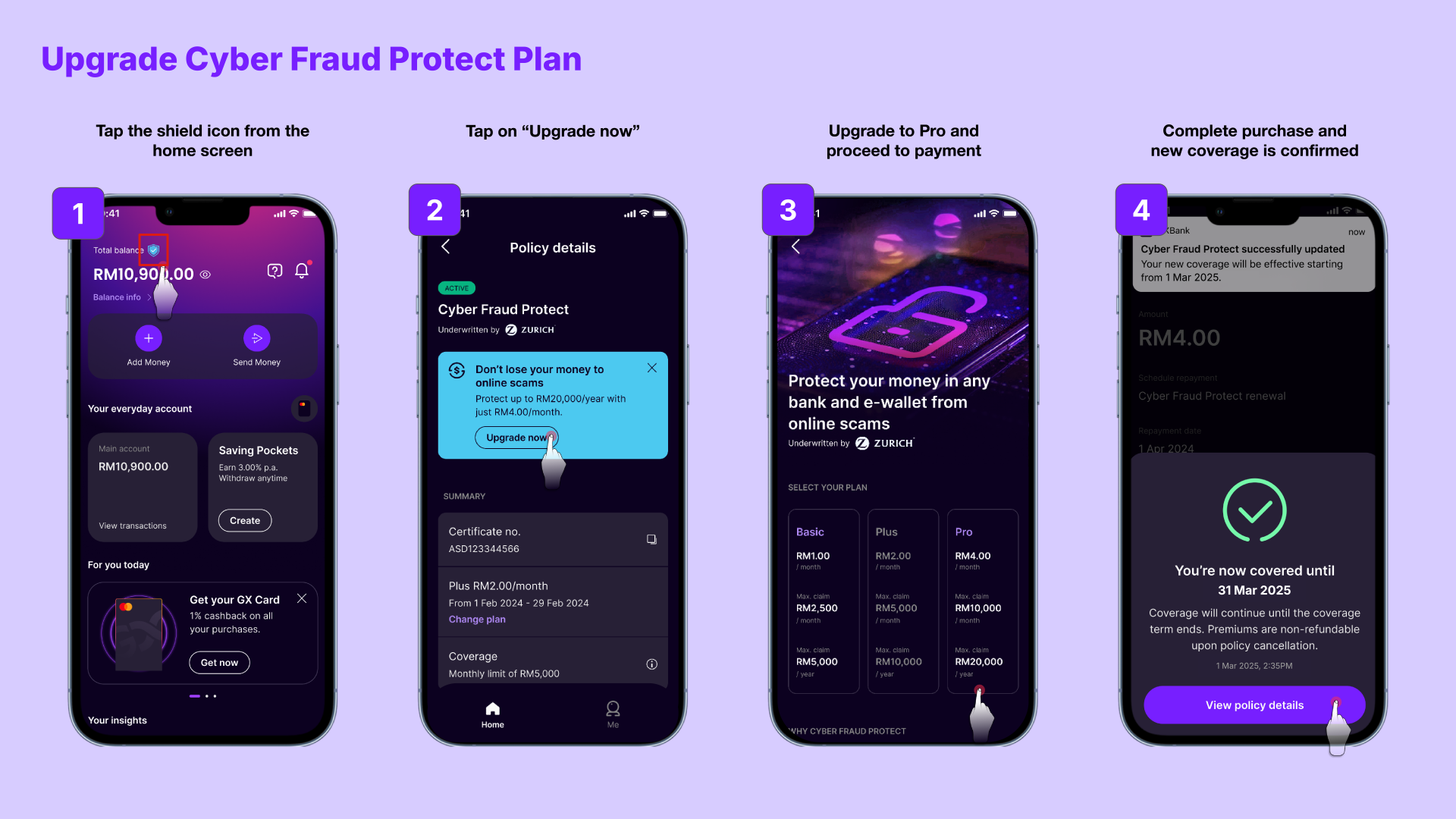

Interested in protecting your hard-earned cash? Here's how you can protect yourself with Cyber Fraud Protect:

Customers interested in securing Cyber Fraud Protect can easily do so via the GXBank mobile app by following these simple steps:

- Select a Plan: Choose from three coverage options — Basic (RM1/month), Plus (RM2/month), or Pro (RM4/month) — directly within the GXBank mobile app, and click "Get Protected Now".

- Key in Details and Confirm: Verify your email address to ensure receipt of all important policy-related communications, and confirm details of the selected plan, including coverage terms and premium breakdown.

- Authorise and Activate: Approve the transaction through GXSecure, and the policy will be activated instantly. Coverage details will be available in the app and a certificate of insurance will be sent via email. The monthly premium will then be automatically deducted from the customer's GXBank account.