3 Things You Should Know About 'Buy Now, Pay Later' Services When Shopping Online

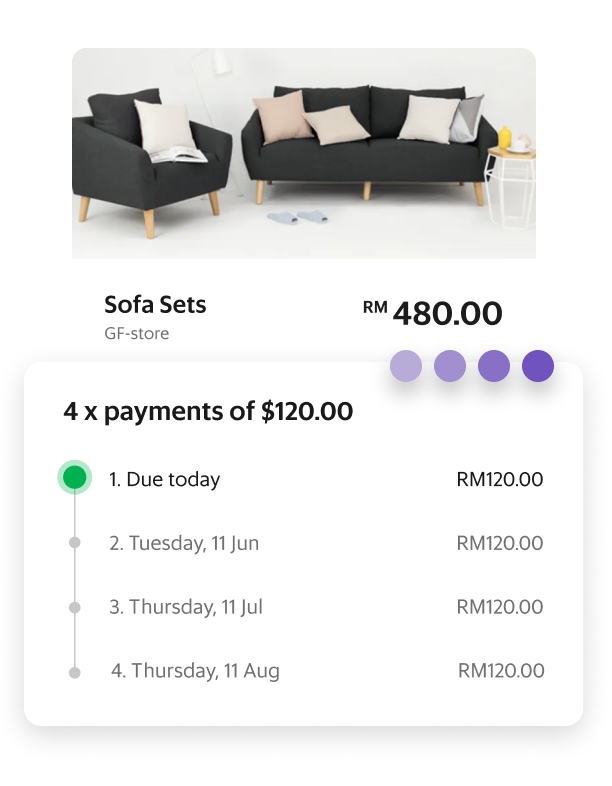

This alternative payment method allows consumers to pay for items in instalments.

Buy Now, Pay Later (BNPL) is quickly emerging as an alternative payment method in Malaysia

With the rise of e-commerce, this flexible payment method is being utilised in different retail industries such as fashion, travel, electronics, gadgets, and more. In fact, even some brick-and-mortar shops are allowing shoppers to use BNPL services.

BNPL allows you to make purchases by splitting the cost into instalments. Whether it's weekly, biweekly, or monthly, the idea is to provide convenience by spreading out your payments over time.

1. You will receive your purchase before completing the entire payment process

As opposed to other payment methods where you need to pay for your purchase in full before receiving it, you will get your item upfront after the first payment. This means you won't have to dip into your savings if you're planning to make a purchase that you can't quite afford yet.

However, it's important to ensure you WILL be able to pay it off in a timely manner. Reviewing your budget every now and then will help you make an informed decision on whether or not to use BNPL.

2. Most BNPL platforms do not charge extra interest

More often than not, there are no hidden fees or interests incurred on BNPL purchases. Although, before you decide to use BNPL services, it's always best to read the terms and conditions before proceeding to checkout. You should know that if you do not pay on time, there may be consequences such as late fees. When in doubt, check the BNPL's fine print.

3. Setting up BNPL is quick and easy, and you don't need a credit card

If you don't have a credit card or e-wallet, you can choose to use your debit card for BNPL transactions. When it comes to setting up BNPL, it is a simple and secure process, as most BNPL providers have their own measures to ensure your personal information is kept safe.

Finding the right BNPL service that suits your spending style is essential in making thoughtful decisions before purchase.

On that note, PayLater by Grab is a BNPL service that offers great flexibility and options for the average consumer. :D

PayLater allows consumers to spread their payments to manage their cash flow better. When you pay for your purchase, Grab will pay the merchant upfront, while you have the flexibility to choose your preferred payment method.

With PayLater, you have two options:

1. Split the cost for up to four interest-free instalments

This means that you will only pay a quarter of the total bill for the next four months.

2. Pay it all the next month

On top of that, you'll even get GrabRewards with this option!

In line with their efforts to encourage responsible spending, Grab has set certain criteria for consumers to be eligible for PayLater

To enjoy PayLater, you must be:

- 21 years and older

- A Platinum, Gold or Silver GrabRewards tier member

- An active Grab consumer using cashless payments

STEP 1: Launch the Grab app on your mobile device.

STEP 2: Tap on Payments

STEP 3: Tap on 'Enjoy now and PayLater' under Explore GrabPay

STEP 4: Once you click 'Activate Now', you will be redirected to a page where you can choose which credit/debit card to link to PayLater

Along with no interest fee or upfront costs, you won't have to pay more as long as you pay on time!