What Does Greece's Debt Crisis Mean For The Malaysian Economy?

Greece stands on the brink of bankruptcy with a potential exit from the eurozone after it failed to meet a crucial debt payment to the IMF on 30 June.

Greece agrees to talks on third bailout deal as Greeks wonder what happened to their 'No' vote

Greek Finance Minister Euclid Tsakalotos talks to European Economic and Financial Affairs Commissioner Pierre Mocovici (R) during a euro zone finance ministers meeting in Brussels, Belgium, July 12, 2015.

Image via Olivier Hoslet / EPAAfter a marathon, 17-hour overnight session — one of the most contentious diplomatic standoffs in European Union history — the announcement of an unanimous deal was made in Brussels. It requires approval from several European parliaments.

washingtonpost.comA key part of the agreement is that a 50 billion euro ($55 billion) fund will be set up using Greek government assets. This will be used to help pay down the country's debts and refinance its banks.

cnbc.comGreece is no longer in danger of exiting the danger zone, but Prime Minister Alexis Tsipras has a set of daunting tasks ahead of him. Before negotiations can begin, several measures will have to be enacted and endorsed by the Greek parliament.

Greek Prime Minister Alexis Tsipras, right, speaks with the media on Monday, July 13, 2015 after a summit of eurozone leaders reached a tentative agreement with Greece for a bailout program that includes "serious reforms" and aid.

Image via AP / Francois WalschaertsTsipras will now have to rush swathes of legislation through parliament this week to convince his 18 partners to release bridging funds to avert a state bankruptcy and just to begin negotiations on a three-year loan.

Six sweeping measures including spending cuts, tax hikes and pension reforms must be enacted by Wednesday night and the entire package endorsed by parliament before talks can start, the leaders decided.

Speaking to reporters after the deal, Greek Prime Minister, Alexis Tsipras, said the most extreme reform plans had been averted, and the country had endured a big struggle for the last six months. He added that the deal's implementation would be difficult, but allowed Greece to return to growth.

cnbc.comA large group of critics from all over Europe - many of them Greek - have taken to Twitter to voice their discontent over the ultimatums set upon Greece, as evident by the trending hashtag #ThisIsACoup that is mainly directed at European leaders

#ThisIsACoup quickly gained the backing of commentators who say Greece should not have to accept more concessions before being granted a third rescue.

"This Eurogroup list of demands is madness," the economist Paul Krugman wrote on his blog. "The trending hashtag ThisIsACoup is exactly right. This goes beyond harsh into pure vindictiveness, complete destruction of national sovereignty, and no hope of relief."

Could someone slip a note to the European leaders about the scale of anger and disbelief building up across the continent? #ThisIsACoup

— javier moreno barber (@morenobarber) July 12, 2015

6 July: Greek finance minister resigns following overwhelming 'no' vote in referendum

Varoufakis, who infuriated eurozone leaders and recently compared Greece’s creditors to terrorists, said the Greek prime minister Alexis Tsipras, thought it would be better if he stood down, after pressure from European leaders.

Announcing his resignation in a blog post entitled “Minister No More!” he wrote:

“Soon after the announcement of the referendum results, I was made aware of a certain preference by some Eurogroup participants [Eurozone finance ministers], and assorted ‘partners’, for my … ‘absence’ from its meetings; an idea that the prime minister judged to be potentially helpful to him in reaching an agreement. For this reason I am leaving the Ministry of Finance today.

“I consider it my duty to help Alexis Tsipras exploit, as he sees fit, the capital that the Greek people granted us through yesterday’s referendum.

“And I shall wear the creditors’ loathing with pride.”

Minister No More! http://t.co/Oa6MlhTPjG

— Yanis Varoufakis (@yanisvaroufakis) July 6, 2015

On 5 July, Greek voters rejected the terms of an international bailout with an overwhelming 61.3% voting "no" on Sunday's referendum. With that, Greece's economic future is now unclear, with experts predicting that a Grexit (Greek exit) from the eurozone may be imminent.

The final result in the referendum, published by the interior ministry, was 61.3% "No", against 38.7% who voted "Yes". Greece's governing Syriza party had campaigned for a "No", saying the bailout terms were humiliating.

Greek Prime Minister Alexis Tsipras said late on Sunday that Greeks had voted for a "Europe of solidarity and democracy".

"As of tomorrow, Greece will go back to the negotiating table and our primary priority is to reinstate the financial stability of the country. This time, the debt will be on the negotiating table," he said in a televised address, adding that an International Monetary Fund assessment published this week "confirms Greek views that restructuring the debt is necessary".

France and Germany - Greece's biggest creditors - have called for an emergency summit of eurozone leaders this Tuesday, while some European officials are of the opinion that Greece's rejection would be seen as a direct dismissal of any further negotiations with creditors

German Chancellor Angela Merkel's deputy said Athens had wrecked any hope of compromise with its euro zone partners by overwhelmingly rejecting further austerity.

Merkel and French President Francois Hollande conferred by telephone and will meet in Paris on Monday afternoon to seek a joint response. Responding to their call, European Council President Donald Tusk announced that euro zone leaders would meet in Brussels on Tuesday evening (1700 BST).

Jeroen Dijsselbloem, who heads the eurozone's group of finance ministers, said the referendum result was "very regrettable for the future of Greece".

Germany's Deputy Chancellor, Sigmar Gabriel, said renewed negotiations with Greece were "difficult to imagine".

Mr Tsipras and his government were taking the country down a path of "bitter abandonment and hopelessness", he told the Tagesspiegel daily.

1 July: On 30 June, Greece became the first developed country to default to the International Monetary Fund (IMF) after failing to pay its debt of €1.5 billion (RM6.7 billion), effectively ending the country's financial lifeline from its 5-year European bailout

Eurozone finance ministers rejected Greek prime minister Alexis Tsipras' last-minute appeal to extend the country's bailout, made just hours before it expired at midnight. Tsipras was reported to have requested for a two-year bailout from Europe - its 3rd in 6 years - amounting to €29 billion.

Greece is now denied any further access to financing from the IMF and its eurozone partners until the debt is cleared. According to a press release from IMF, Greek authorities have filed a formal request to the fund's Executive Board for an extension of the country's repayment obligation.

Greece has required Europe-led bailouts worth €240 billion over the last five years to avoid bankruptcy, receiving the cash in return for slashing public spending.

The last bailout involved the European Commission, the European Central Bank, and the International Monetary Fund (IMF) lending Greece those emergency funds.

Greece's total debts amount to €242.8 billion (RM1 trillion), including loans made under two bailouts from European governments and the IMF as well as Greek government bonds held by the European Central Bank and national central banks in the eurozone

Greece, which is set to default on an International Monetary Fund debt repayment due on Tuesday, owes official lenders 242.8 billion euros ($172.03 billion pounds), according to a Reuters calculation based on official data. Germany is by far the largest creditor.

That figure includes loans made under two bailouts from European governments and the IMF since 2010 - worth a nominal 220 billion euros so far, of which some has been repaid - as well as Greek government bonds held by the European Central Bank and national central banks in the euro zone.

Private investors hold 38.7 billion euros of Greek government bonds following a major write-down and debt swap in 2012 that reduced the Greek debt stock by 107 billion euros and the value of private holdings by an estimated 75 percent.

The Greek government has also issued 15 billion euros in short-term Treasury bills, mostly to Greek banks.

The country rejected a new proposal to extend its bailout deal from creditors last week, stating that the amount is too little and that the proposed reforms are very likely to cause recession.

Prime Minister Alexis Tsipras has called for a referendum on 5 July, where Greek voters will vote on whether the country should accept the terms of the bailout or leave the eurozone.

Tsipras urged voters to reject creditors' demands, insisting a "No" vote in next Sunday's referendum would strengthen Athens' negotiating hand.

"We ask you to reject it with all the might of your soul, with the greatest margin possible," he said on state television. "The greater the participation and the rejection of this deal, the greater the possibility will be to restart the negotiations to set a course of logic and sustainability."

Shortly after that, the Greek government announced that banks across the country will shut down for a week (29 June to 6 July) as capital controls are implemented, including a daily withdrawal limit of €60 per card, on 28 June

Long lines were seen at many ATMs on Sunday as Greeks scrambled to withdraw whatever funds they could from their bank accounts before they closed.

Image via Milos Bicanski / Getty ImagesForeign tourists, however, will be able to make cash withdrawals from ATMs provided their cards are issued abroad. Electronic transactions, such as with credit or debit cards as well as Internet and phone banking, will also be conducted as normal.

Greece's decision to shut its banks and potential exit from the eurozone saw a majority of Asian stock markets - including the Shanghai Composite Index and Tokyo's Nikkei - taking a dip

The Shanghai Composite Index fell 3.7 percent to 4,035.48 points despite China’s surprise weekend interest rate cut. Tokyo’s Nikkei 225 index shed 2.4 percent to 20,218.17 points.

Hong Kong’s Hang Seng lost 2.7 percent to 25,949.30 and Sydney’s S&P ASX-200 was off 2.3 percent at 5,418.80. Seoul’s Kospi dropped 1.4 percent to 2,061.00 and India’s Sensex declined 1.6 percent to 27,370.30. The euro slipped to $1.101 from the previous session’s $1.116. The dollar declined to 123.15 yen from 123.89 yen.

focusnews.com

focusnews.com

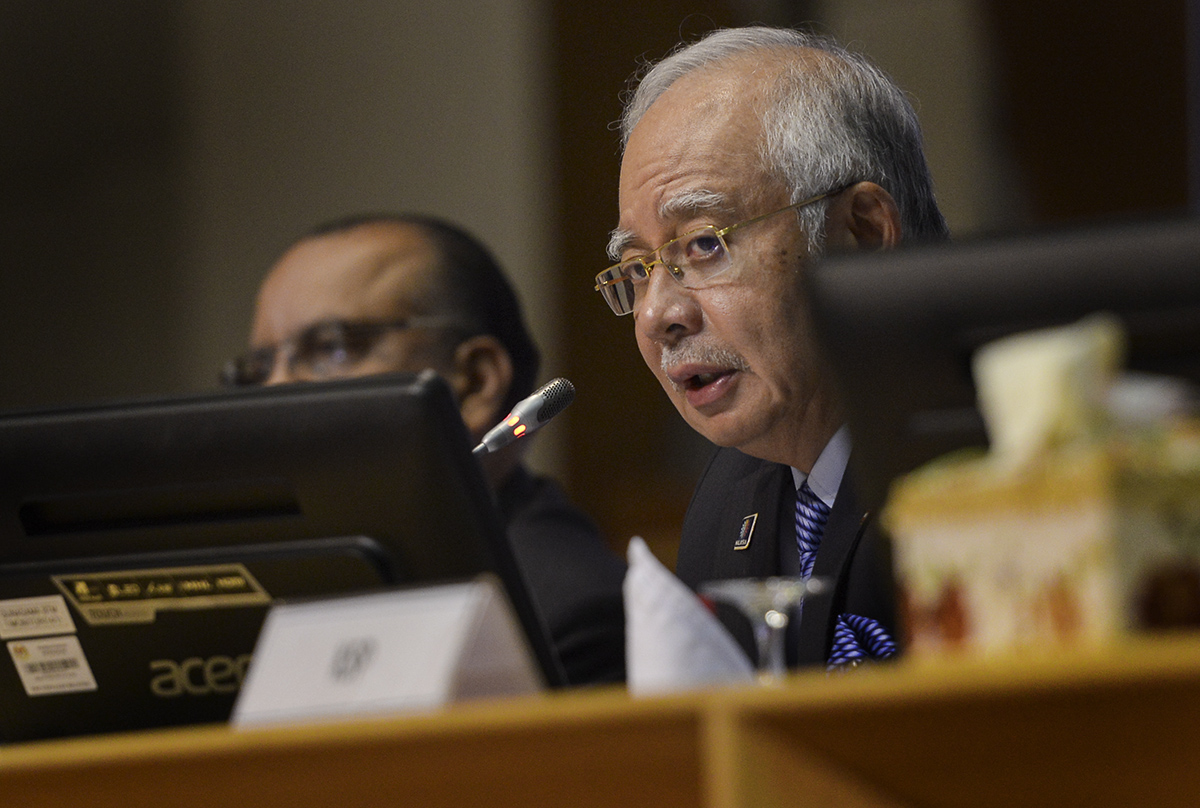

Amidst concerns of a contagion effect on the global economic situation, PM and Finance Minister Najib Razak said that Greece's financial crisis will not have any systemic effect on the Malaysian economy, but the global impact could still indirectly affect the country

“We will see the global impact but I want to see the development in the next one or two days. The key factor is whether Greece remains part of the Eurozone or it will pull out of it. We (Malaysia) have to see the event. We also need to monitor and see global sentiment and how it plays up,” Najib said.

Analysts seem to agree with Najib, saying that the likelihood of a direct and serious impact on the Malaysian economy is quite minimal as there are no products with exposure to Greece

Areca Capital chief executive officer Danny Wong felt the risk of a contagion effect on the Malaysian economy was “quite removed”.

“There is a small chance it will affect the rest of the world. but indirectly through perhaps a programmed sell-down by fund managers due to Greece’s exit because they are overweight on developed countries and underweight on emerging markets,” he said.

Wong thinks the impact on the direct economy would be minimal, especially since the country does not have products with exposure to Greece.

Meanwhile, MIDF Research said the Greece problem would have little fundamental impact to Malaysia’s economy and the local financial market except for a negative transitory shock in the short term.

However, a report from Barron's Asia suggests that Malaysia will be placed in a very vulnerable position if Greece exits the eurozone and European banks start repairing their balance sheets by cutting back their debt holdings in Asia

Besides Asia’s two financial hubs - Hong Kong and Singapore - Malaysia has the largest exposure to European bank claims. As of the end of last year, European banks had debt claims the size of 17.7% of Malaysia’s GDP. The next runner-up is Korea, with only 8.7% of its GDP in the form of debt held by European banks.

In addition, money has been leaving Malaysia - an oil exporter - this year even without the Grexit. Malaysia’s financing gap, defined as current account minus portfolio outflows (in equity and bond) runs a good 4.1% of its foreign exchange reserve.

So far, the ringgit has seen minimal effects from Greece's financial problems. Furthermore, Fitch Ratings have maintained Malaysia's credit ranking and even revised the financial outlook to "stable" from the previous "negative" evaluation.

Fitch maintained Malaysia's long-term foreign currency issuer default rating at A- and local currency at A, with the outlook revised to stable from negative previously.

Stocks went up and the ringgit rose as much as 1.1% to 3.7330 per dollar, its strongest since June 23. The Malaysian currency stood at 3.7350 at 0017 GMT (8.17am Malaysian time). The Malaysian currency was the second-worst performing Asian currency so far this year, partially due to worries about a potential rating downgrade.