Highlights From The Revised Budget 2016 And How It Affects You

There's much to celebrate for the JPA scholarship hopefuls.

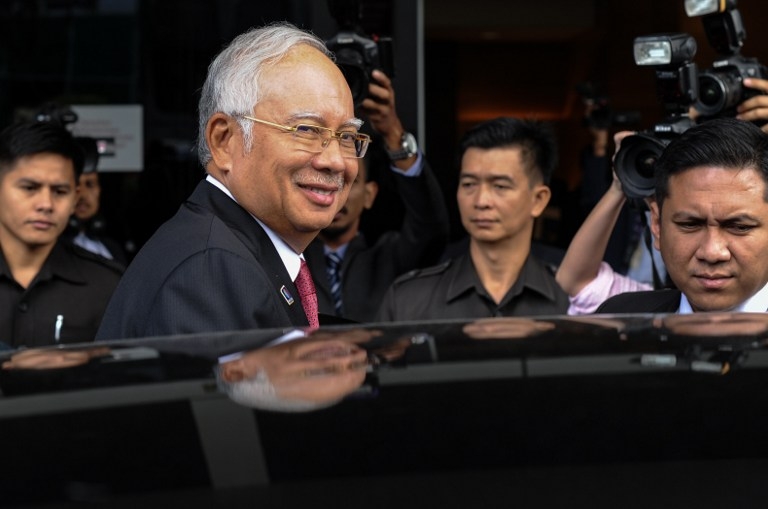

On Thursday, 28 January 2016, Prime Minister Najib Razak, who is also the Finance Minister, announced a revised Budget 2016. The PM said that the recalibration is necessary due to a slump in global oil prices and a slower economic growth in the USA and China.

The Prime Minister said the government revenue would be based on Brent crude oil at US$30 to US$35 per barrel when compared with the US$48 when it prepared the Budget 2016 last year. He also said the economy was expected to grow at a slower pace of between 4% and 4.5% when compared with the earlier forecast of 4% to 5%.

thestar.com.myIn essence, 11 recalibrated key measures were announced. Saying the recalibrated budget was based on the approach of "shared responsibility" by certain segments of society, Najib assured that the lower-income groups will not be affected, and continue to benefit from measures such as the 1Malaysia People's Aid (BR1M).

He also said that Malaysia would not resort to imposing capital controls and pegging the Ringgit, such as was done during the 1997-1998 financial crisis.

"The Government remains committed to maintaining the fiscal consolidation measures for 2016, which is to achieve a GDP target of 3.1%. Our country's debt will be reduced and will not exceed 55% of the GDP. The Government also has no plans to impose capital controls and peg the Ringgit," he said.

Here are the 11 recalibrated key measures:

1. EPF contributions by employees to be reduced by 3%. This is expected to increase private sector spending by RM8bil.

2. Tax relief of up to RM2,000 to those with income RM8,000 a month or lower. Two million taxpayers to benefit.

3. To reduce cost of living, Govt to liberalise APs for agricultural products including coffee beans and meats.

4. Domestic Trade, Cooperatives and Consumerism Ministry ordered to increase enforcement and action against unethical traders.

5. 30% of contributions to the human resource development fund to be utilised for skills training, including those who are unemployed.

6. MyBeras programme to be introduced until Dec 2016. Each hardcore poor family will be given 20kg of rice every month.

7. The Government will update the management system of foreign workers, with levies clustered into two categories, not including foreign maids.

8. Government will exercise prudent spending on supplies and services and to continue with grant rationalisation.

9. Development budget to focus on projects and programmes that place the people first, have high multiplier effect and reduce imports.

10. Development financial institutions and Government venture capital funds to increase allocations by RM6bil for benefit of start-ups and SMEs.

11. GLCs urged to implement initiatives to reduce the income gap between senior management and workers, to be monitored by the Economic Planning Unit.

One of the above key measures is to reduce the employees' contribution to the Employees Provident Fund (EPF) by 3% from March 2016, which will bring their current contribution of 11% of their monthly salaries to EPF down to 8%. However, the percentage of employers' contribution remains the same, PM Najib said.

"This measure is expected to increase private consumption expenditure by RM8bil a year," he said.

Deputy Finance Minister Datuk Johari Abdul Ghani said the EPF contribution reduction has put more money into the rakyat's pockets.

"Employees will receive returns of 3% of their EPF contribution immediately. So if your income is RM5,000 a month, you will receive RM150. Over twelve months, that's extra money to spend," he said, adding that increasing consumer spending will stimulate the economy.

EPF said they would be releasing a press statement on the matter soon.

There's also tax exemption of RM2,000 for Malaysians earning RM8,000 and below for the financial year of 2015, a move, PM Najib added, that would affect two million taxpayers

"Although the Government will forego revenue of RM350mil, it will provide individual tax savings of up to RM475, which will benefit some two million taxpayers," he said.

thestar.com.myThere's much to celebrate for the JPA scholarship hopefuls in the revised Budget 2016, as the government will continue the following four Public Service Department (JPA) scholarships for 2016:

1. The National Scholarship Programme (Program Biasiswa Nasional) will allow 20 top SPM-scorers to pursue their studies in universities abroad;

2. The Engineering Special Programme (Program Khas Kejuruteraan) for 200 students to pursue their studies in Germany, France, Korea and Japan;

3. The Bursary Programme (Program Lepasan Bursary) for 744 students to pursue their undergraduate degrees in public and private higher education institutions in the country; and

4. Scholarships for 8,000 students to pursue undergraduate degrees locally.