Najib's Take On Why Malaysia's Stock Market Fell And What Experts Have To Say

He wrote a Facebook post following a sharp fall of the Bursa Malaysia index on Wednesday.

Former premier Datuk Seri Najib Razak penned a lengthy Facebook post dedicated to the Pakatan Harapan government late Wednesday, 23 May

In the post, Najib said that the credibility of Malaysia's numbers and institutions could be doubted by mixing political narratives with facts.

1. The stock market fell after Tun Dr Mahathir announced that the country’s debt was now RM1 trillion

"Saying that our debt is now RM1 trillion without giving any details of what you mean will just unsettle the financial markets, alarm the credit rating agencies, and investors' confidence in our institutions," Najib wrote.

Calling the claims about the national debt "alarming and confusing", Najib wrote that investors and credit rating agencies will be alarmed by such statements. He also alleged that "tens of billions of ringgit" in market value were wiped out in a day as a result of Mahathir's claims.

The Edge Markets reported that RM31.7 billion were wiped off the market on Wednesday.

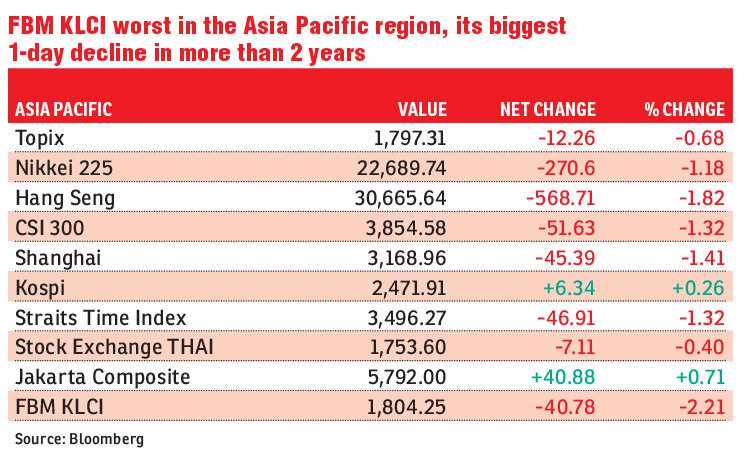

The FTSE Bursa Malaysia KLCI (FBM KLCI) dropped by 40.78 points on Wednesday, according to The Star. Rakuten Trade Sdn Bhd vice-president of research Vincent Lau told The Edge Markets that it could be resulted from the announcement of Malaysia's RM1 trillion debt.

"The RM1 trillion headline has spooked the market," Lau said, before encouraging investors to look past the "noises" regarding Malaysia's debt.

"Our Bursa Malaysia index fell the most among all worldwide stock markets," Najib wrote, in reference to the plunge of the index.

While the RM1 trillion debt headlines could be considered a 'spook factor', it wasn't the sole reason that led to the stock market fall according to experts

The Edge Markets reported Loui Low, head of retail research for Hong Leong Investment Bank Bhd, as listing out a few other reasons for the plunge:

• Concerns about Malaysia's debt management,

• Possible decrease in tax collection following the zero-rated goods and services tax (GST),

• Poorer corporate results.

Founder of Loanstreet and Finology Jared Lim told SAYS that it is uncertain if the stock markets fell simply because of the RM1 trillion debt announcement.

On the same day of the FBM KLCI's dive, Reuters reported that Asian shares fell in general. Investors were anxious after US President Donald Trump expressed dissatisfaction with the US-China trade talks, which caused a U-turn in a previously optimistic market sentiment.

2. Najib also criticised statements minimising the consequences of a downgrade in Malaysia's credit ratings

"Issuing statements that we should not worry about our country's sovereign credit ratings being downgraded will result in further rocking the confidence in our institutions," Najib wrote, before alleging that the government will face debt financing costs of RM10 billion per year.

He also claimed that a downgrade will lead to huge capital outflows, causing the Ringgit to weaken.

Nonetheless, Rakuten Trade's Vincent Lau argues it was too early for rating agencies to decide.

Lau thinks the impact from a downgrade "will not be significant", after arguing that it is too early for rating agencies to decide on Malaysia's credit ratings. The agencies would need time to evaluate policy changes.

"I also think the impact from a downgrade on small- and mid-cap companies would be limited as these companies' borrowings are likely to be coming from local banks," Lau was quoted as saying by The Edge Markets.

Furthermore, Loanstreet's Jared Lim also told SAYS that the agencies give out credit ratings based on the fundamental health of a country's economy, instead of fluctuations in the market.

"The fundamentals would have been unaffected by whether (the RM1 trillion) debt was pronounced or not," Jared said, before adding that the debt announcement merely brought new information to light.

However, The Star previously reported Moody's Investors Service as saying that some campaign promises of the Pakatan Harapan government would be "credit negative" for the country.

Moody's also said the government's revenue base will be narrowed without any measures to offset the loss from a zero-rated GST.

Head of markets strategy at National Australia Bank in Singapore, Christy Tan was also reported as saying that markets are in for a rough ride following the historical results of the 14th General Election.

"While the result is cheered by Malaysians, this means more uncertainties for international investors," she said.

In his closing remarks, Najib reminded the Pakatan Harapan government that Malaysians should come first

Najib alleged that the government may want to "slander and put all the blame" on him to justify undelivered manifesto promises.

"You must remember that the country and our people comes first," he wrote.

"The time to play politics is over," he added, after claiming that "misleading" statements regarding 1Malaysia Development Berhad (1MDB) have been issued to blame him.

"Words spoken while in such positions of power result in actual losses to the country and the people, as was proven today in the stock market."