Customers Were Ready To Flip The Table After Reading This GST Notice

It has gone viral on FB, with people calling it Grand Imperial's PR disaster!

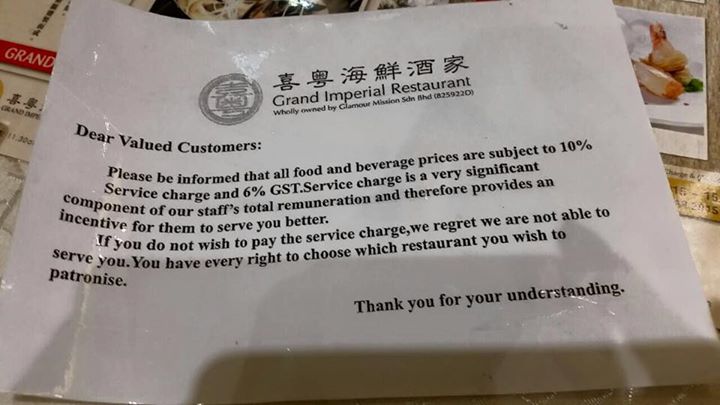

Grand Imperial Restaurant recently issued a notice to its customers, which was uploaded on Facebook by KH Ng. The notice explicitly asks its customers to pay the service charge or else the Grand Imperial will not serve them. It further says that in the event of such, the customer can, of course, choose to go to different restaurant.

The notice, thanks to its patronising tone, has since gone viral. At the time of writing this story, it has received over 2,400 shares!

Almost everyone who has shared the notice on their Facebook, is calling it a PR disaster, with several of them echoing the sentiment that the outlet could have chosen a friendly message instead of being too straight forward, which comes off as being rude!

With the implementation of GST from 1 April, there have been heavy discussions on the need for service charge as several restaurants maintain their 10% service charge with an additional 6% GST on top of this charge.

However, since 6 April, the ministry announced that hotels and restaurants are no longer allowed to impose the 10% service charge unless they have an agreement with employees:

Are you confused about what exactly is the service charge?

First things first, the 'service charge' you see in receipts is not a government tax, it's different from 'service tax'. It's a surcharge independently added on by the establishment in exchange for the service provided. To understand what is service charge and whether or not you need to pay it, read our guide here: