13 Important Things To Look Out For In Budget 2015

Prime Minister Najib will be announcing his "people-centric" Budget 2015 on 10 October 2015. Here's what analysts are expecting to see from the budget, compiled from research notes and media reports.

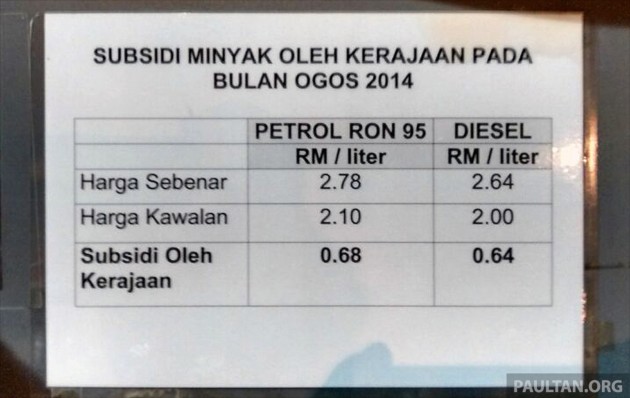

1. Targeted fuel subsidy scheme

Najib could announce reform of the fuel subsidy regime in order to move away from a blanket subsidy for all consumers in favour of a system that benefits lower to middle-income earners. Abdul Wahid Omar, a prime ministerial aide, has said private firms have submitted proposals for fuel prices to be charged based on income levels, vehicle types and engine capacities.

2. Further subsidy cuts

The government may look to reduce subsidies on essential food items, such as flour and cooking oil, as well as household gas, said RHB Research.

3. More exemptions from GST

The Goods and Services Tax (GST) will be implemented in April 1, 2015 at a rate of 6%. Fresh food, public transport, education fees and healthcare are currently exempted. Maybank Investment Bank Research expects the government to announce an amended list that may include more exemptions. Maybank reckons GST revenues could decline to RM2.4 billion from RM4 billion for the April to December period, and RM7 billion for 2016 from the initial projection of RM9 billion.

4. Operational expenses

The Fiscal Policy Committee may introduce measures to contain the size of the civil service and limit the portion of total operating expenses that salaries take, said RHB Research.

thestar.com.my5. Higher BR1M cash aid and increased minimum wage

Bantuan Rakyat 1Malaysia (BR1M), a programme to hand out cash assistance to households earning less than 4,000 ringgit a month and individuals earning less than 2,000 ringgit, could be increased by 300 ringgit, said AmResearch. The expansion in BR1M will likely cost the government 7.5 billion ringgit in 2015, up from 4.6 billion ringgit last year, the bank added. The minimum wage may be raised, accompanied by measures to enhance productivity, said Hong Leong.

thestar.com.my6. Stronger measures to curb speculation in the property market

Exemptions on stamp duty for first-time house buyers may be extended, said Alliance DBS Research. The current incentive saves buyers 50 percent of stamp duty costs on residential properties below 400,000 ringgit, and is due to expire at the end of this year.

Real property gains tax (RPGT) may be raised further this year, to curb speculation, said Kenanga Research. The RPGT rate was increased in 2013 to 30 percent for properties held for less than three years. For disposals within the holding period up to 4 and 5 years the rates rose to 20 percent and 15 percent.

thestar.com.myStrong measures to curb property speculation still risk slowing down consumption and domestic demand, said Affin Investment Bank. A GST rebate may be introduced on building materials used in the construction of medium to low cost properties, MIDF Research said in an interview with Business Times.

7. Lower corporate taxes and new tax reliefs for households

Corporate taxes may be lowered by more than the 1 percent cut announced for 2016, as Malaysia's tax rates are still higher than regional peers, said Kenanga Research. Other banks predict that the government is more likely to bring forward the cut in corporate taxes rather than increase the amount of the cut. New tax reliefs for households may be announced, to further alleviate the cost of living, said Alliance DBS.

8. More development funds to improve the country's railway infrastructure especially for eastern and northern peninsular Malaysia and west Malaysia

More funds may be allocated to improve the country's railway infrastructure and network. This includes ongoing work in Kuala Lumpur, and the planned commuter train linking Singapore to Johor Bahru, said Maybank.

thestar.com.myThe government may allocate more development funds for states in eastern and northern in peninsula Malaysia, said Kenanga Research. Sarawak state, could also receive more funds, mainly for its rail network and the Sarawak Corridor of Renewable Energy, said Maybank.

9. Higher oil royalties for Sabah, Sarawak and Terengganu

The states of Sabah, Sarawak and Terengganu may be awarded higher royalties on oil production than the current 5 percent rate, said Maybank. In May, Sarawak requested that the rate be raised to 20 percent. Other states would expect the same treatment, said Maybank.

10. Tax incentives to promote Islamic bonds in foreign currencies

Tax incentives could be offered to promote Islamic bonds in foreign currencies, Maybank said. Non-ringgit sukuk account for less than ten percent of all issuances.

11. More incentives to attract foreign direct investment

More incentives may be offered to attract higher value-added export oriented foreign direct investment (FDI), said RHB Research.

13. Bigger allocation for PTPTN study loans

Analysts expect a bigger allocation for the PTPTN study loans to enable students to pursue post-graduate degrees, which in turn would spur on the K-economy. More funds will probably also be set aside for research and development and incentives given for researchers to commercialise their products. The budget is also expected to address the need to give more citizens access to higher education as well as provide incentives to improve the knowledge economy.