7 Simple Tips To Help You Save More On Your Daily Expenses

Every little bit you save adds up!

1. Evaluate your spending before you make a budget

Before you plan out a budget for yourself, spend as usual over the span of a month while tracking your expenses as you go. Take note of things like what you spend on, how much you spend, which categories do you spend more in, etc.

Then, take all these things into consideration when setting your budget. For example, if you find that you spend more on food, allocate more money for that. This will help you come up with a more realistic budget that you're more likely to stick to, instead of one that leaves you feeling like you have not enough money.

2. When cooking at home, double the recipe

By doubling the recipe, you'll be cooking a bigger batch of food, and you can then freeze the leftovers for another day. This way, you can not only use ingredients more efficiently with less waste, but also save on gas and/or electricity.

Additionally, here are some extra ways to save more when grocery shopping for ingredients:

- Make a meal plan before you shop so that you'll only buy specific things you need, rather than lots of random things you may or may not use

- Design your meal plan to revolve around seasonal ingredients, as in-season items are usually cheaper

- Opt to buy generic brands instead of name brands

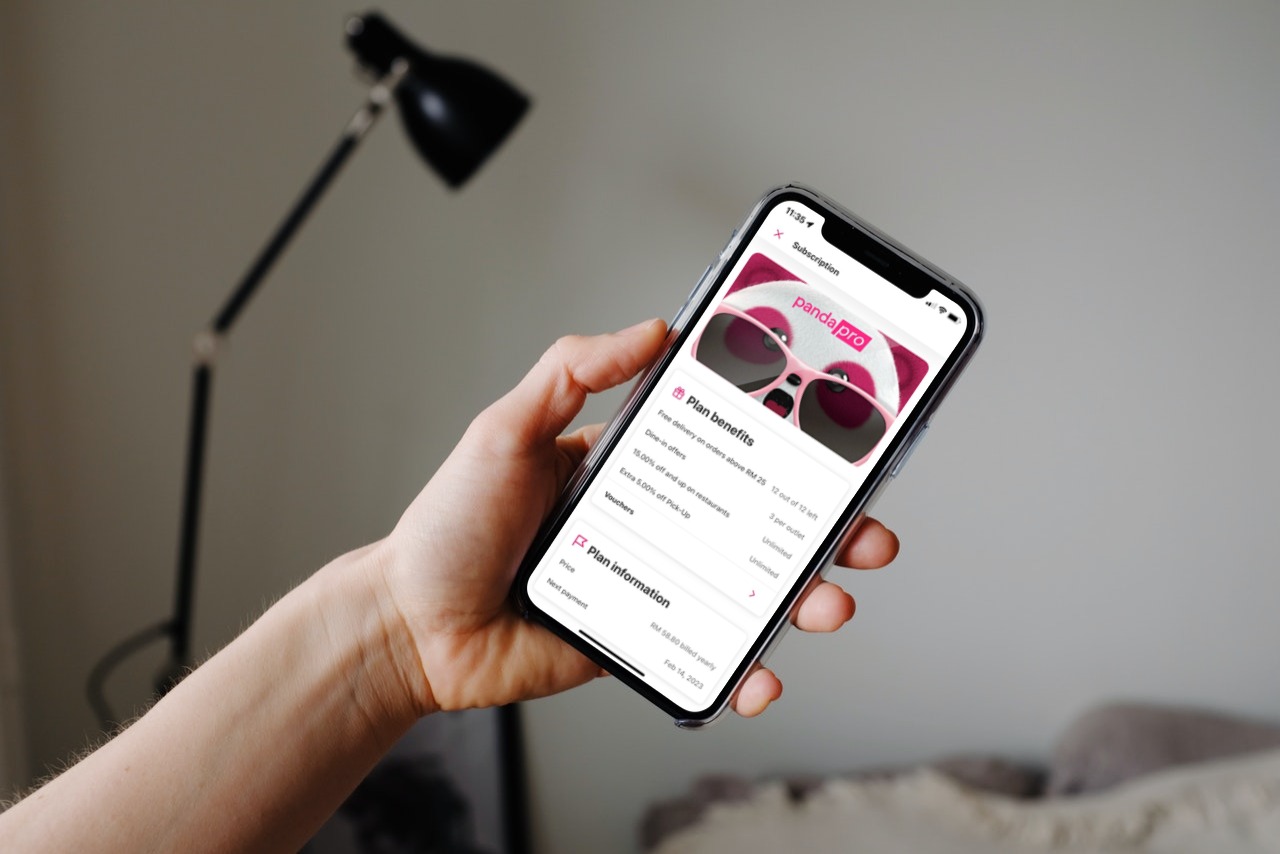

3. Take advantage of subscription deals and family plans

For services that you use often, check to see if they have plans that will help you save more in the long run. Many services have options such as family plans which are more affordable because you'll be dividing the fee with other people.

Otherwise, some also have specialised subscription deals that give you discounts and other benefits. For instance, those who order delivery often should check out foodpanda's pandapro subscription package, which offers perks such as free delivery, discounts, vouchers, and more.

4. When you treat yourself, make it a point to save as much as you spend

Whether it's treating yourself to bubble tea while you're out jalan-jalan or buying that new gadget you've been eyeing, we all have our little indulgences that we splurge on every once in a while.

A good way to still save without having to give up the things you enjoy is to set a rule where you save as much as you spend. If you buy a new outfit for RM50, put RM50 into your savings as well.

5. Instead of price, look at how many hours you'll have to work to afford your purchases

This may sound complicated, but it actually just involves a simple calculation. Based on your monthly gaji, work out what your hourly wage is. Then, all you have to do is divide the price of the item you want to purchase by your hourly wage.

Consider whether it's worth it to work as long as you'll need to in order to afford the item you want to buy.

Here's an example

Monthly salary: RM3,200

Hourly wage:

- RM3,200 / 20 working days (minus weekends) = RM160 a day

- RM160 / 8 working hours per day = RM20 per hour

Price of item you want to buy: RM100

Hours you'll need to work to afford item: Five hours

6. Have a "no spend day" once a week

Just one day of not spending can go a long way in helping you save up. However, that doesn't mean you have to do nothing all day long (though if you want to go that route, that's totally fine too :P).

You can still do whatever you want — the only rule is make sure all your activities don't cost money. This means doing things like cooking at home instead of eating out, or going for a walk in the park instead of out shopping.

7. Order water instead of fancy beverages when you eat out

Ahh, there's nothing like enjoying a satisfying cup of coffee or a refreshing soft drink with your meal. But the reality is that getting a drink along with your food can rack up the cost of your bill when you dine out, especially if it's one of those fancy beverages.

Opt for water instead, which is usually the cheapest option on the menu, or sometimes, it's even free.

Knowing how much Malaysians love a good deal, foodpanda came up with their pandapro subscription package to help you save more on your daily expenses, yay!

With this affordable subscription package, you'll get to save so much on your everyday spending, whether it's ordering delivery, buying groceries, or dining at your favourite restaurant.

Check out all the perks of a pandapro subscription:

- 12 x free delivery

- 20% off on 20,000 selected restaurants

- 20% off vouchers on pandamart

- Up to 25% off for dine-in

So, whether you like to stay home and have yummy eats delivered to you or prefer to makan at your fave restaurant, a pandapro subscription will still help you save more.

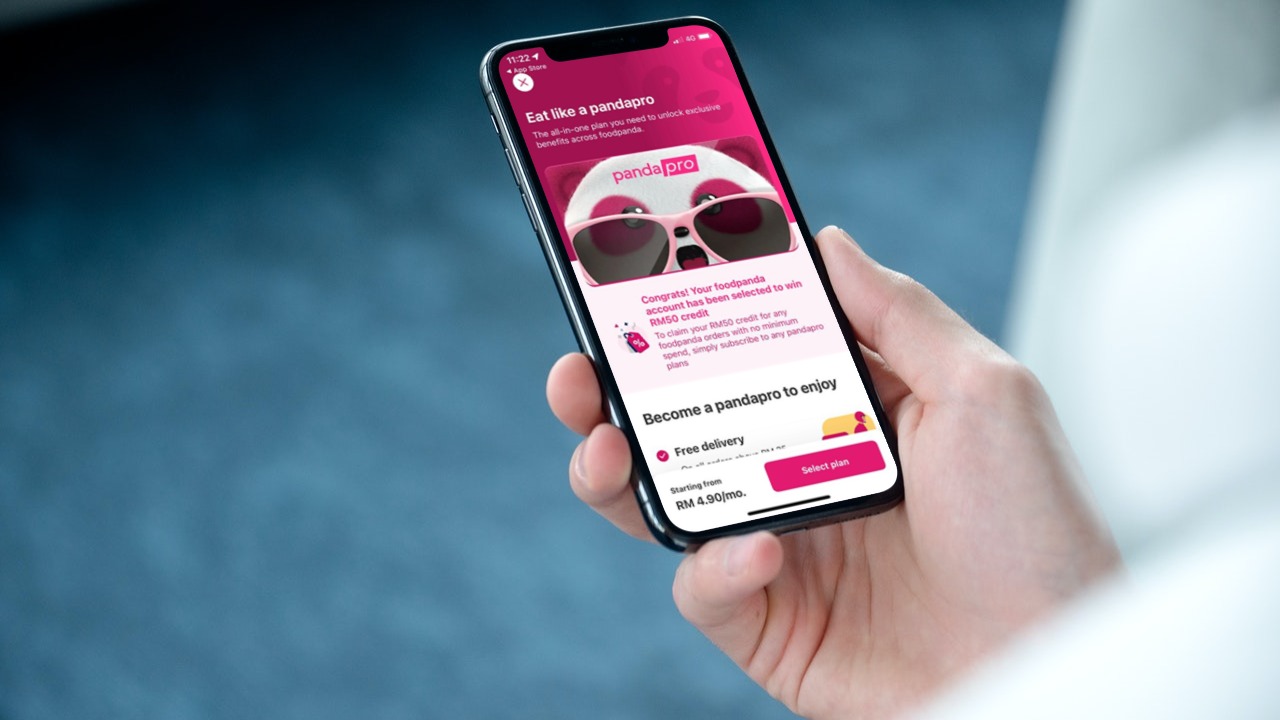

And guess what? foodpanda is currently giving out RM50 cash vouchers and two months subscription rebate, wahhhh!

That's right, four million lucky pandapro subscribers will be getting RM50 cash vouchers that can be used on food and groceries, as well as two months rebate on your pandapro subscription.

All you have to do is sign up for any pandapro plan, then check the app to see if you're one of the lucky winners!

Here are the pandapro plans you can opt for:

- One month @ RM8.90 per month, 70% off

- Six months @ RM6.90 per month, 77% off

- 12 months @ RM4.90 per month, 84% off