5 Important Things You Actually Need To Know Before You Purchase Your First Home

Don't underestimate all the hidden costs!

Buying your first home is one of the biggest decisions you will ever make

That's why it's important to cover all your bases before deciding on your dream home. However, you'll be surprised at how many Malaysians are actually unaware of the extra costs that come with purchasing a home.

1. The downpayment for your home is usually 10% of the property price

The biggest sum you have to pay when buying a house is the downpayment, which is usually 10% of the property price. That means you'll need to prepare an upfront cost of RM50,000 if you're buying a RM500,000 home. The remaining 90% is normally paid through a housing loan.

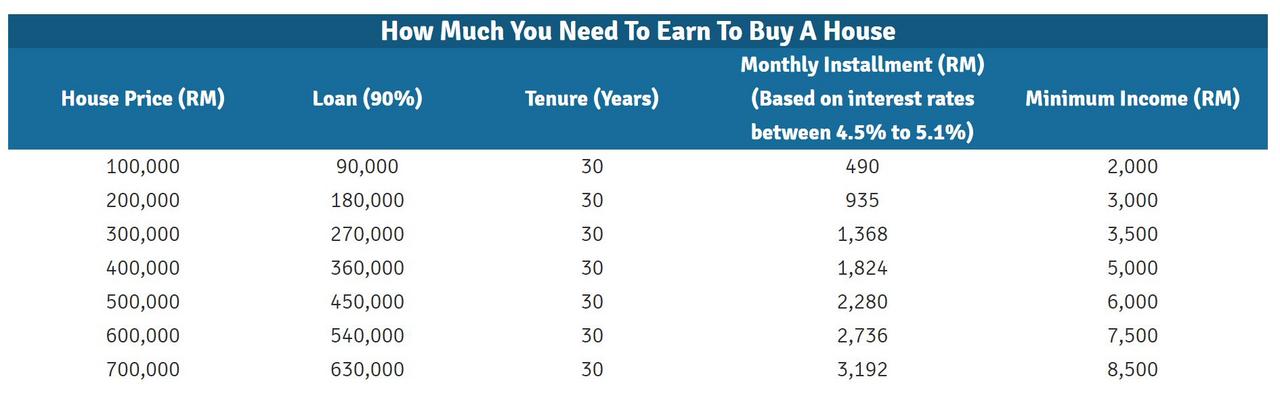

2. Your housing loan should be no more than a third of your monthly salary

Once you've booked your property, that's when you start applying for housing loans. The general rule of thumb is to spend no more than a third of your salary on monthly instalments for your home. Based on the table above, you would need a minimum income of RM6,000 to afford a RM500,000 home.

3. The SPA, or Sale and Purchase Agreement, is a document you sign to confirm that you are buying the house

Once you've booked your unit and succesfully gotten your housing loan, this is when it's time to sign your Sale and Purchase Agreement (SPA).

An SPA is a contract between you and the developer (or seller). You'll need a lawyer to prepare the document. What you need to know is that this entire process comes with professional legal fees, property stamp duty, disbursement fees, and 6% SST.

4. Besides the downpayment, there are various legal fees and other costs involved

Calculating the costs can seem confusing, so use this simple online tool to find out how much you actually need to purchase your property.

While legal fees and other costs vary from person to person, it's a good practice to set aside an extra 7-10% of your property price to cover these costs. For instance, if you're looking to get a RM500,000 home, you'll want to have a spare RM35,200 on hand in addition to your downpayment.

5. Here are the pros and cons to buying a home that's already built compared to one that's under construction

This really depends on what your priorities are. If you're buying a home for investment, new properties usually give you a higher potential for return. This also gives you more time to plan your financials.

However, if you're looking to move into a place soon, you may want to consider going for homes that are already built. Besides the convenience, you'll also get to see the actual unit instead of having to imagine it based on brochures or show units.

While buying your first home may seem daunting, the good news is that you don't have to go through this journey alone

Sunway Property wants to help you own your first dream home with its Super 5 campaign. All it takes is five simple steps to own a Sunway home:

- Get a 95% housing loan from Sunway

Instead of the usual 10% downpayment, all you have to do is prepare a 5% downpayment and Sunway's group of companies will provide a 95% housing loan. This means you won't have to worry about applying for a loan from the bank. - Just pay RM5,000 to own your home

The great thing about Sunway Super 5 is that you won't have to pay the 5% downpayment upfront. In fact, you can own your home by paying only RM5,000 and settle the remainder later. - Enjoy free Memorandum Of Transfer (MOT)

Besides the government's waiver of MOT for first time home buyers, Sunway will also absorb the stamp duty for the transfer of ownership for properties above RM1 million. - Take your time to pay your downpayment with Sunway's Flexi Instalment plan

Pay the 5% downpayment with an Easy Payment Plan up to 24 months. - Get your free financial health check

This financial health check will help you gain a better idea of your financial standing and increase your chance of getting loan approved.

With over 17 projects to choose from, you'll definitely be able to find the home of your dreams with Sunway Property

Sunway properties in Klang Valley:

- Sunway Serene, Petaling Jaya

- Sunway Subang Business Park, Kampung Subang

- Sunway GEOLake Residences, Petaling Jaya

- Sunway Gandaria Residences, Bandar Baru Bangi

- Infiniti 3 Residences, Wangsa Maju

- Sunway Eastwood, Equine Park

- V Residence Suites @ Sunway Velocity, Kuala Lumpur

Sunway properties in Johor Bahru:

- Sunway Citrine Residences, Sunway Iskandar

- Sunway Citrine Lakehomes, Sunway Iskandar

- Sunway GRID Residence, Sunway Iskandar

- Sunway GRID Retail & Shoppe, Sunway Iskandar

- Sunway Lenang Heights, Taman Molek, Johor Bahru

- Sunway Citrine Residences, Sunway Iskandar

- Sunway Citrine Lakehomes, Sunway Iskandar

- Sunway Emerald Residence, Sunway Iskandar

- Sunway GRID Residence, Sunway Iskandar

- Sunway GRID Hub, Sunway Iskandar

Sunway properties in Penang and Ipoh:

- Sunway Cassia, Batu Maung, Penang

- Sunway Wellesly Precinct 3, Bukit Mertajam, Penang

- Lakeside Mansions, Sunway City Ipoh

- Serene Villas, Sunway City Ipoh

Ready to own your dream home? Find out more about the Sunway Super 5 campaign on their website today