If You're A Sole Prop Or Business Owner, Here's Why You Should Start An LLP

Interested in starting a new LLP in Malaysia? Here's my ultimate guide.

For those of you who are starting your very own micro business in Malaysia, a Limited Liability Partnership (a.k.a. Perkongsian Liability Terhad, PLT) is likely your best business model to start with

I started mine about 1.5 years ago, and while I’m not a certified expert or anything — I’ve spent too many hours reading obscure documents by various government agencies to let it go to waste. This post covers the 5 Wives and 1 Husband on new LLPs in Malaysia. Who, What, When, Where, Why and How?

It’ll cover the “first cycle” of your new baby LLP’s life. Hopefully after you’ve gone through this first cycle, you’ll know what to do and just focus on running your core business smoothly.

Here’s the ultimate guide to starting your own LLP in Malaysia:

Why Limited Liability Partnerships?

Simon Sinek says great leaders start with “Why,” so we’ll start with that too.

If you recall what you learned in high school during Kemahiran Hidup, you’ll know that there are a few forms of businesses, each with their set of advantages and disadvantages. Of course, instead of listening to Puan Mariah, you were busy playing Command and Conquer with your pretty classmate Siti. So let me break it down for you:

There are sole proprietorships (Milikan Tunggal), partnerships (Perkongsian), cooperatives (Koperasi), private limited companies (Sendirian Berhad) and public limited companies (Berhad).

Know why you never heard of Limited Liability Partnerships when you were in school?

No, it wasn’t because Siti was flirting back with you, (she was actually just bored). It was because LLPs didn’t exist back then. They’re a new type of business entity — and they’re fascinating. Here’s why.

The concept of separate entities

Okay, I actually hate the word entity because it doesn’t bring up the image of anything in my head. WTF is an entity?

In layman’s language, an entity is a thing that is independent. So for example: you’re an entity, I’m an entity, and Ah Chong Auto Services where you service your car is an entity. But here is where it gets interesting: some businesses are separate entities from their owners.

Now this doesn’t feel natural. Maybe because we’re brought up with traditional values that businesses are made up of the people that run them. So if you think of Tesla, you think of Elon Musk. If you think of Virgin (not that one perv), you think of Richard Branson. If you think of Tesco, you think of the kind Nepali guard named Bishal who helped secure your plastic bag.

But the great thing about separate entity is it allows you to keep your personal life and business life separate. And allows for some really cool things — like say, for the company you created to continue living on even after you’re gone. Since it’s a separate entity from you — it doesn’t need you to be around. This is called continuity of existence.

Here’s another example: Rich Dad, Poor Dad author Robert Kiyosaki’s supposed bankruptcy. Some people have been saying recently, “Oh, he’s a fraud — if he knows so much about money, how come he can go bankrupt?”

He didn’t go bankrupt, silly. One of his many companies declared bankruptcy. Note the difference: Kiyosaki’s company declared bankruptcy, not Kiyosaki. And it probably hasn’t affected his wealth much. He’s likely got it all stored in other safe places.

But if he had been running a business that wasn’t a separate entity from himself (e.g. a sole-proprietorship), then yes — he’d be in deep shit.

Deep sh*t vs limited liability

Just like in Kiyosaki’s case, there are always risks that business will go bad, and you need to make things right.

The lawyers call this liability, but I prefer to call it “being responsible for deep shit.”

The good news is there are business forms that protect you from going bankrupt even if your business does. And as you’ve probably guessed by now — a Limited Liability Partnership does exactly that (like the much more common Sendirian Berhads). At worst, you’ll lose all the money you invested into your business — but nothing more.

“Why not a Private Limited (Sendirian Berhad) company then? My friend says this is the best business format!”

Because Private Limited companies are expensive to start and more difficult to maintain (~RM 1,500 to start, ~RM 2,500 per year to maintain). If you have lots of capital though, they might make sense for you.

If you’re getting confused by my long-winded explanations:

TL;DR: Choosing the correct business model can protect you and your money.

The who's who of LLPs

Feel free to skip this paragraph if you’re an experienced business owner. If you’re a noob like me though — it’s important to understand who the players are:

1. Suruhanjaya Syarikat Malaysia, SSM (Companies Commission of Malaysia, CCM) — where you register your LLP, get its “birth certificate,” and do your annual declarations.

2. Lembaga Hasil Dalam Negeri, LHDN (Inland Revenue Board, IRB) — who you pay your taxes to and where you register for tax filing.

3. Other Government Agencies (e.g. Employees’ Provident Fund, EPF; Social Security Organization, SOCSO; Human Resources Development Fund, HRDF).

We’ll get into more detail on what you need to do with each of these agencies, but the point I wanted to make is this: a one-stop portal/counter where you can do everything does not exist. You will be dealing with multiple parties — each with their own ways of doing things. So please don’t get upset when the counter lady gives you the classic Malaysian line: “Oh, ini kena pergi jabatan lain…”

Again, the above will seem painfully obvious if you’re already a seasoned Jabatan runner. But sometimes I have people asking me, “Why can’t I open a bank account for my LLP at SSM?”

Because they’re separate entities.

“But why not just run my side business quietly, don’t declare anything, and keep all the income? My friend’s aunt teaches tuition quietly and she’s damn rich! It’s the ultimate life hack! F*ck the government. Hihi.”

Yes, I totally understand your desire to pay as little tax as possible, and there are completely legal ways to do that. But I also believe in running legitimate businesses that are properly registered. It’s the ethical thing to do. Besides, you don’t want to mess with LHDN. I hear they can mess your life up pretty bad.

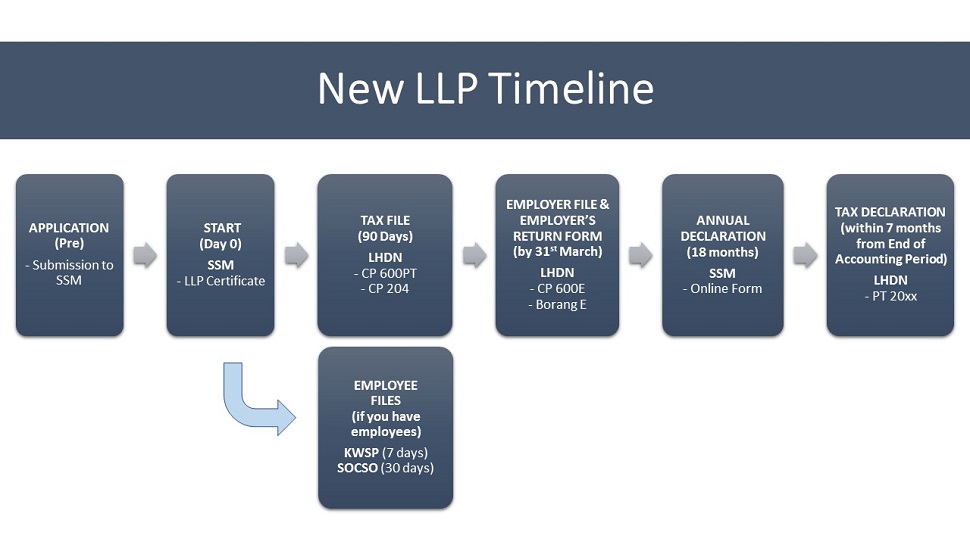

When do I need to do what (first cycle)?

Here’s where it gets exciting. Because here’s where we talk about what needs to be done, and when.

SSM and LHDN make up the majority of this section — because they’re the two major government agencies that you’ll need to report to.

(I don’t have experience running a business with employees, so my knowledge on dealing with the EPF and SOCSO is almost zero. If you know about that, and would like to add to this article — please comment below!)

Here’s a timeline of what needs to be done and when:

1. Application

Start by submitting your LLP application to SSM. Detailed instructions here.

2. Start

Once you’ve gotten your LLP certificate — we’ll call that Day 0.

3. Tax file

Register your LLP for a Tax File at a nearby LHDN branch:

1. Use Form CP 600PT.

2. You’ll also need to submit copies of your LLP certificate (from Step 1) and stamped LLP agreement.

3. You can stamp your LLP agreement at any LHDN branch. It costs RM 10, and takes just a few minutes. Won’t go into detail on how to fill up the form here, but it’s really simple — just ask the helpful LHDN people at the counter.

Not sure how to do an LLP agreement?

Enquire here, or email my partner at [email protected] and get a discount because I referred you.

LLP agreement packages start from RM 1,200.

Caution: When I went to LHDN Petaling Jaya, they said it’d take 3 working days, and in addition to LLP certificate and LLP agreement — they also needed IC copies of all the partners. That sucked, as I didn’t have the IC copies with me.

Pro Tip: So I went to LHDN Jalan Duta instead. And got it done within 15 minutes. (No IC copies required.)

Once you’ve registered your tax file, LHDN will issue you a letter which tells you your “No. Cukai Pendapatan” (Income Tax Number).

It should look like this: PT xxxxx xxxxx (10 digit number)

With your Income Tax Number, you can now do the next step: which is to file your LLP’s Income Tax Estimate:

- Use Form CP204.

- Since this is your first year in business, you have 90 days to submit your income tax estimate.

- For some reason, you can only submit Form CP204 (for LLPs) to the LHDN Branch in Bangi (by post/hand). Still waiting for their online system to be ready!

Pro Tip: If you’re an SME (less than RM 2.5 million paid-up capital, and not related to a company > RM 2.5 million capital), you don’t need to fill up the tax estimate portion for the first 2 years. As in, you fill submit Form CP204 anyway, but leave sections 2 and 6 blank.

Reference: CP204 for SMEs

4. Employers File & Employers Return Form

Here’s where it got a bit confusing for me. Since I have no employees, I thought I could skip this step. But apparently LHDN wants all LLPs to still register for an Employer’s File, and submit Employer’s Return Forms (Borang E) every year.

How to register your LLP for an Employer’s File (Fail Majikan)? You’ll need to head to a nearby LHDN branch and submit this form. (Remember to bring copies of your LLP certificate and ID too.)

For Employer’s Return Forms, it depends on when you start your business.

You’ll always have to submit Borang E by 31 March of the following year.

For example:

If you start in November 2016, you’ll need to submit Borang E to LHDN by 31 March 2017.

But if you start in January 2017, you’ll need to submit Borang E to LHDN by 31 March 2018.

Download Borang E at LHDN’s website.

5. Annual declaration

If you’ve made it to this point, you’ve already been running a (hopefully) successful business for some point now. It’s time to do your first annual declaration to SSM.

Your first annual declaration needs to be done within 18 months from your LLP’s registration date.

For subsequent years, it needs to be done within 90 days from the end of your LLP’s financial year.

This allows you the flexibility to choose a financial year that makes sense. So for example, if your LLP was registered on 12 July 2017, here’s an example of a financial year that doesn’t make sense:

Financial year: 12 July – 11 July

First accounting period: 12 July 2017 – 11 July 2018

First Annual Declaration: 12 July 2017 + 18 months = by 11 Dec 2018

Future Annual Declarations: 11 July + 90 days = ???

Tax submission (more on that in section below): 11 July + 7 months = ???

Here’s a more straightforward financial year:

Financial year: 1 Jan – 31 Dec

First accounting period: 12 July 2017 – 31 Dec 2018

First Annual Declaration: 12 July 2017 + 18 months = by 11 Dec 2018 (the only time you’ll have a weird deadline)

Future Annual Declaration: 31 Dec + 90 days = by end March every year

Submission of Tax Declaration: 31 Dec + 7 months = by end July every year

So please make sure to choose a sensible financial accounting period.

Annual declarations cost RM 200, and can be done fully online at MyLLP Customer Portal. If you have all your documents and information ready, I’ll bet you can do it within an hour.

For SSM’s comprehensive guide on how to do Annual Declarations, click here.

6. Tax declaration

This is perhaps the most complicated part of all. Why? Perhaps because LLPs are new business structures — good documentation on how to do things is lacking.

So let me try my best to explain LLP tax declaration in plain language:

When to submit? Within 7 months from the end of your accounting period. For example, if your accounting period is 1 Jan to 31 Dec (like in previous section), you need to submit your tax declaration by end July. If your accounting period is 1 July to 30 June, you need to submit your tax declaration by end February.

How to submit? For LLPs, tax submission is a fully manual process. Online tax submission for LLPs is not possible for now.

What to submit? Form PT 20xx. For reference, here’s Form PT 2016 in Bahasa and English. (The English form is for reference only.) You need to submit the Bahasa Malaysia version of the form to LHDN.

Where to submit? Submit Form PT 20xx by post/hand to the address below:

Pusat Pemprosesan Maklumat,

Lembaga Hasil Dalam Negeri Malaysia,

Menara Hasil,

No. 3, Jalan 9/10, Seksyen 9,

Karung Berkunci 221,

43659 Bandar Baru Bangi,

Selangor.

Note: Please do not submit the following for LLPs:

Form B (that’s for if you’re a sole proprietor) or Form P (that’s for a partner in a conventional partnership).

For your personal income tax (remember that?), you still need to submit Form e-BE online. Remember, LLPs are separate entities from their partners. So they file tax separately.

What do you need to know to do LLP tax filing by yourself (i.e. without paying a tax agent to do it for you)? Basic accounting knowledge, and knowing how to read financial statements.

And here’s LHDN’s Guide on how to fill up Form PT 2016.

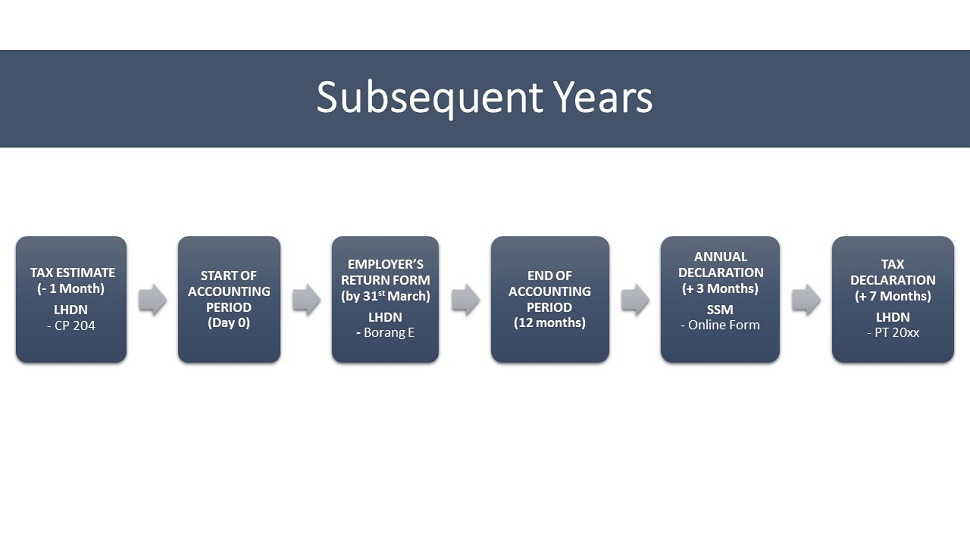

The next cycle and the future

Now that we’ve made it through Cycle 1 (phew!), it’s pretty smooth sailing from here onwards:

For subsequent years:

- Tax Estimate (Form CP204) needs to be submitted at least 1 month before the start of your financial year.

- Employer’s Return Form (Borang E) needs to be submitted by 31 March of every year.

- Annual Declaration needs to be done within 3 months of the end of your accounting period.

- Tax Declaration needs to be done within 7 months after you’ve closed your books.

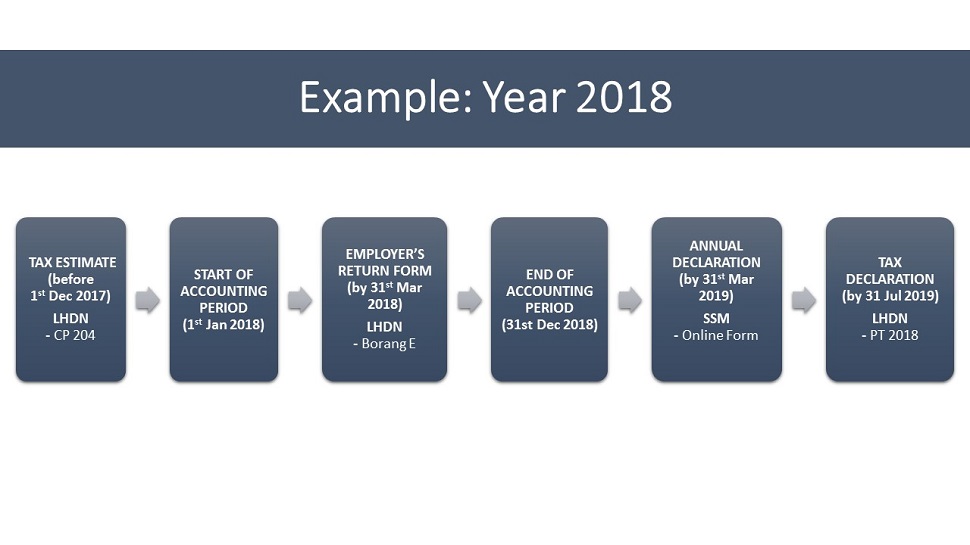

And just to demonstrate how this looks, here’s an example for an LLP whose financial year is from 1 January to 31 December for next year:

How can I get more information?

LHDN has a pretty good website, where you can download all the forms necessary, and read official documentation regarding tax.

SSM‘s website is pretty good too, though not as well-maintained as LHDN’s one. But the reporting requirements for LLPs are simple — so you probably only have to deal with SSM once every year.

If you have any other burning questions, comment below and I’ll try to answer asap. Plus, some of my beloved readers sometimes help answer questions too. Thanks guys!

Finally, if you’ve made it this far, you either work for SSM/LHDN, you’re writing a thesis on LLPs in Malaysia, or you’re genuinely interested in starting a DIY business.

Whichever it is, I wish you the best — and hope you make tons of money.

The full article originally appeared on mr-stingy.com.

This story is the personal opinion of the writer. You too can submit a story as a SAYS reader by emailing us at [email protected].

Read more SAYS stories from Aaron here: