7 Simple Steps To Help You Manage Your Finances And Repay Debts Like PTPTN Loans

PTPTN is offering a 15% discount on loan repayments until 31 Mac 2024.

If you've started working, you'll probably understand the struggle when it comes to managing your finances, especially if you have outstanding debts like your housing loan, car loan or etc.

Amidst soaring tuition fees and hefty academic expenses, PTPTN loans have been a lifeline for countless Malaysians, enabling them to pursue their studies and secure fulfilling careers. With this financial support, aspiring students can focus on their chosen fields without worrying about the burden of financial constraints.

However, upon graduating and stepping into the working world, the responsibility of repaying your PTPTN loan becomes a priority. Generally, the PTPTN borrowers Repayment Schedule is built on the 13th month after the end of the loan period.

While repaying PTPTN loans may not be exciting, being able to effectively manage and settle the debt will bring you one step closer to financial independence.

1. Before diving into repayment strategies, it's essential to understand the terms and conditions of your PTPTN loan

Familiarise yourself with the ujrah rates, repayment period, and any other relevant details. This knowledge will empower you to make informed decisions and plan effectively for the future.

2. Create a realistic budget that suits your lifestyle

Evaluate your monthly income, including salary, allowances, and any additional sources. Then, deduct essential expenses such as rent, utilities, and groceries. Allocate a specific amount for your PTPTN repayment to ensure timely settlements without compromising your overall financial wellbeing.

3. Consider a repayment plan

PTPTN offers various repayment plans to accommodate different financial situations. You can choose a plan that aligns with your income, which allows for flexibility. For instance, the Income-Contingent Loan Repayment (ICR) plan adjusts your repayment amount based on your income, ensuring that you contribute a manageable percentage of your salary.

4. Prioritise high-interest debts

If you have multiple loans, consider prioritising the repayment of higher-interest debts. Tackling these debts first can save you money in the long run, as interest accumulates more rapidly on loans with higher rates.

5. Take advantage of early repayment discounts

PTPTN encourages early repayment by offering attractive discounts on outstanding balances. You should seize the opportunity as this helps reduce your overall repayment amount by settling your loan ahead of schedule.

6. Explore employer repayment programmes

Some employers in Malaysia offer loan repayment assistance as part of their employee benefits. You can check with your employer to see if such programmes are available and whether you qualify.

7. Keep yourself informed about any changes in PTPTN policies, interest rates, or repayment options

It is advisable to regularly check the official PTPTN website or contact their customer service for any updates, as they may offer discounts or rebates from time to time.

To encourage Malaysians to repay their education loans, PTPTN is organising a 'Jom Bayar PTPTN' campaign, where you can win cash prizes worth up to RM70,000

From now until 31 December, those who repay their PTPTN loans at any PTPTN branch will not only be entitled to win cash prizes, but also get a discount of up to 15% on their loans.

This campaign is in conjunction with their 'Hari Mesra Pelanggan', which aims to help those who have PTPTN loans.

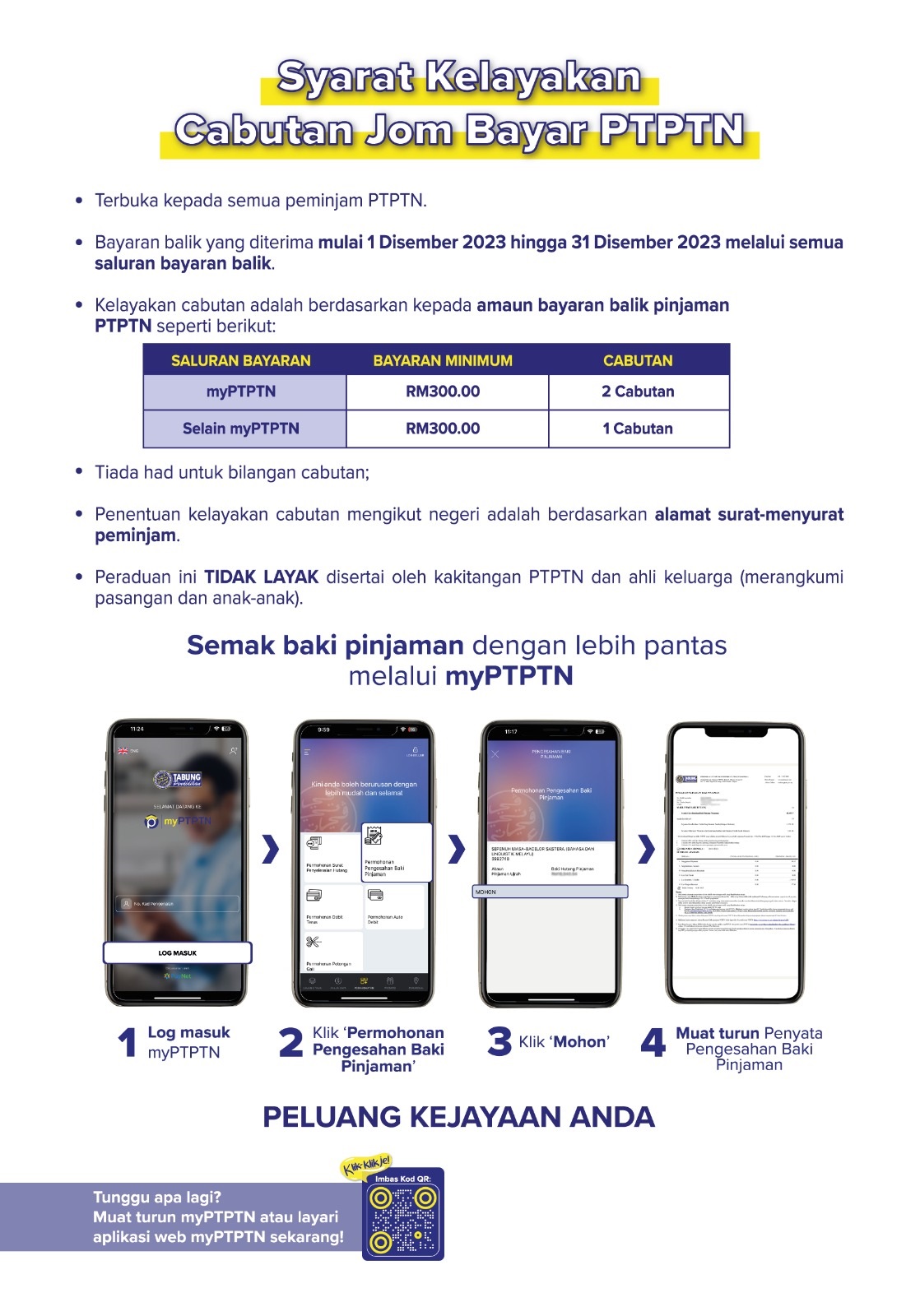

What's even better is that if you pay a minimum amount of RM300 to restructure your loan, you'll be entitled to join their Jom Bayar PTPTN draw

When you use myPTPTN apps to pay the loan, you'll gain two entries. And, if you use other methods to pay the loan, you will get one entry.

Here's a look at the prizes:

- Grand Prize: RM2,000 (one winner at each of the 14 states)

- Second Prize: RM1,000 (one winner at each of the 14 states)

- Third Prize: RM500 (three winners at each of the 14 states)

- Consolation Prize: RM100 (5 winners at each of the 14 states)

You'll also get a chance to win exclusive PTPTN merch!

This is the best opportunity for all borrowers to negotiate with PTPTN officials. Borrowers can not only enjoy loan repayment discounts, but also have the opportunity to restructure loans with more attractive offers, have the chance to win lucrative prizes and get exclusive souvenirs from PTPTN. This 4 in 1 benefit is very worthwhile for borrowers in conjunction with Hari Mesra Pelanggan PTPTN and Jom Bayar PTPTN Campaign.

Here's how to qualify for the Jom Bayar PTPTN draw:

All you have to do is make your repayments from 1 December to 31 December 2023. Also, make sure your mailing address is updated before you make your repayment. The contest is exclusive to PTPTN borrowers only.

Ready to work towards financial independence? Learn about PTPTN's 'Jom Bayar PTPTN' campaign on their website.