Mothers Can Claim Up To RM1,000 Tax Relief For Buying Breastfeeding Equipment

This tax relief was announced during the tabling of Budget 2017.

Taxpayers would usually want to maximise the tax relief that they are eligible for

Tax relief allows you to get a deduction and reduce the amount on which tax is paid. This simply means you get to lessen your chargeable income (or taxable income), and thus you'll pay a lower amount of tax.

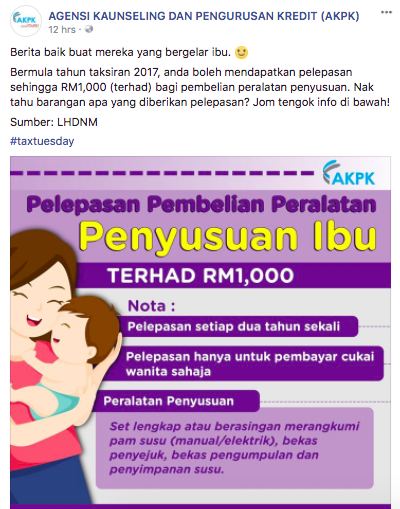

As the income tax filing season draws nearer, the Credit Counselling and Debt Management Agency or Agensi Kaunseling dan Pengurusan Kredit (AKPK) in Malay, has reminded taxpayers in a Facebook post to take advantage of the tax relief offered for the purchase of breastfeeding equipment.

Individuals may claim up to RM1,000 of tax relief from breastfeeding equipment purchases

Based on Section 46(1)(q)(a) of Income Tax Act 1967, breastfeeding equipment refers to a breast pump kit and an ice pack, a breast milk collection and storage equipment, and a cooler set, or bag.

According to a document by Lembaga Hasil Dalam Negeri (LHDN), this tax relief, which can only be claimed once every two years, is applicable to working women with children aged two years and below.

It is understood that this deduction will not be allowed for a year of assessment immediately following that year of assessment. This means that if a claim for this tax relief is made for the year of assessment 2017, then the next claim can only be made for the year of assessment 2019.

This tax relief is fairly new, as it was first announced in 2016 by Prime Minister Datuk Seri Najib Razak during the tabling of Budget 2017.

Like most, if not all tax relief claims, individuals must keep and provide the receipt(s) as evidence of purchase or payment

Aside from the purchase of breastfeeding equipment there are various deductions that taxpayers can take advantage of, ranging from lifestyle tax relief such as Internet subscriptions and gymnasium membership fees to tax relief for education purposes.

Visit the LHDN website to view the full list of tax reliefs available to maximise the tax savings that you are eligible for.