Here Are The Income Tax Reliefs You Can Claim For The 2023 Assessment

The deadline to file your income tax returns is 30 April 2024!

1. Individual and dependent relatives relief - RM9,000

If you are unmarried, this relief will be granted automatically.

If you are an individual with disabilities who is registered with the Social Welfare Department (JKM), you will be granted an additional RM6,000 relief.

2. Spouse relief - up to RM4,000

This relief is only applicable if your spouse has no source of income and if they opt for a joint assessment under your name.

If your spouse is disabled, you are granted an additional relief of RM5,000.

The relief is also granted to divorced individuals who are paying alimony to their former spouse.

3. Child relief - RM2,000 per child

If you are married with children, you can claim a relief of RM2,000 for each unmarried child under the age of 18 years.

If you have a disabled child registered with JKM, you can claim a relief of RM6,000.

4. Additional relief for children (18+) in full-time education - up to RM8,000 per child

You can claim tax relief of RM2,000 for each unmarried child aged 18 and above who is enrolled in full-time education, such as A-Levels, certificate, matriculation, or preparatory courses.

Meanwhile, a higher deduction of RM8,000 can be claimed if the unmarried child aged 18 and above is:

- pursuing further education in Malaysia (diploma level or higher)

- pursuing further education outside Malaysia (degree level or higher)

If your disabled child is pursuing higher education (diploma level or higher), whether inside or outside Malaysia, you are entitled to an additional RM8,000 tax relief.

5. Self education fees - up to RM7,000

If you are currently paying for your own higher education, you can claim this income tax relief.

However, the income tax relief is only eligible for the following categories of study:

- Postgraduate (masters or doctorate) - any course of study

- Undergraduate - if your course is in law, accounting, Islamic financing, technical, vocational, industrial, scientific, or technology

6. Medical expenses for self, spouse, or child - up to RM10,000

This relief is claimable for medical expenses related to:

- Serious diseases for self, spouse, or child

- Fertility treatment for self or spouse

- Vaccination for self, spouse, and child (capped at RM1,000)

Other medical expenses that you can claim relief for up to RM1,000 are:

- Complete medical examination for self, spouse, or child

- COVID-19 detection test, including the purchase of self-detection test kit for self, spouse, or child

- Mental health examination or consultation for self, spouse, or child

You can also claim up to RM4,000 relief for these medical expenses for your child under 18 years old:

- Assessment of intellectual disability diagnosis

- Early intervention programme or intellectual disability rehabilitation treatment

7. Medical expenses for parents - up to RM8,000

A taxpayer can claim relief for medical treatment, special needs, and carer expenses for their parents if they have a medical condition certified by a medical practitioner.

8. Lifestyle purchases for self, spouse, or child - up to RM2,500

You can claim this tax relief for the following expenses:

- Purchase or subscription of books, journals, magazines, newspapers, or other similar publications

- Purchase of personal computer, smartphone, or tablet (not for business use)

- Purchase of sports equipment for sports activity and payment of gym membership

- Payment of monthly bill for internet subscription (under own name)

9. Additional sports-related purchases relief - RM500

In addition to the general lifestyle tax relief, you can claim tax relief for more sports-related expenses, such as:

- Purchase of sports equipment for any sports activity as defined under the Sport Development Act 1997 (excluding motorised two-wheel bicycles)

- Payment of rental or entrance fees to sports facilities

- Payment of registration fees for sports competitions where the organiser is approved and licensed by the Commissioner of Sports under the Sport Development Act 1997

10. Purchase of supporting equipment for self (if a disabled person) or for disabled spouse, child, or parent - up to RM6,000

11. Breastfeeding equipment - up to RM1,000

This tax relief is only available to mothers with a child aged two years and below.

12. Childcare fees - up to RM3,000

You can claim this relief is you have paid fees to a registered childcare centre or kindergarten for a child aged six years and below.

13. Electric vehicle (EV) charging equipment - up to RM2,500

You can claim this tax relief for the fees associated with purchasing, installing, or renting EV charging equipment. It also includes the subscription for the use of EV charging facilities.

14. Employees Provident Fund (EPF) contributions and life insurance - up to RM7,000

If you are an employee who contributes to EPF, you are entitled to deduct up to RM4,000 for your EPF contributions under this tax relief, as well as up to RM3,000 for your personal life insurance premium payments.

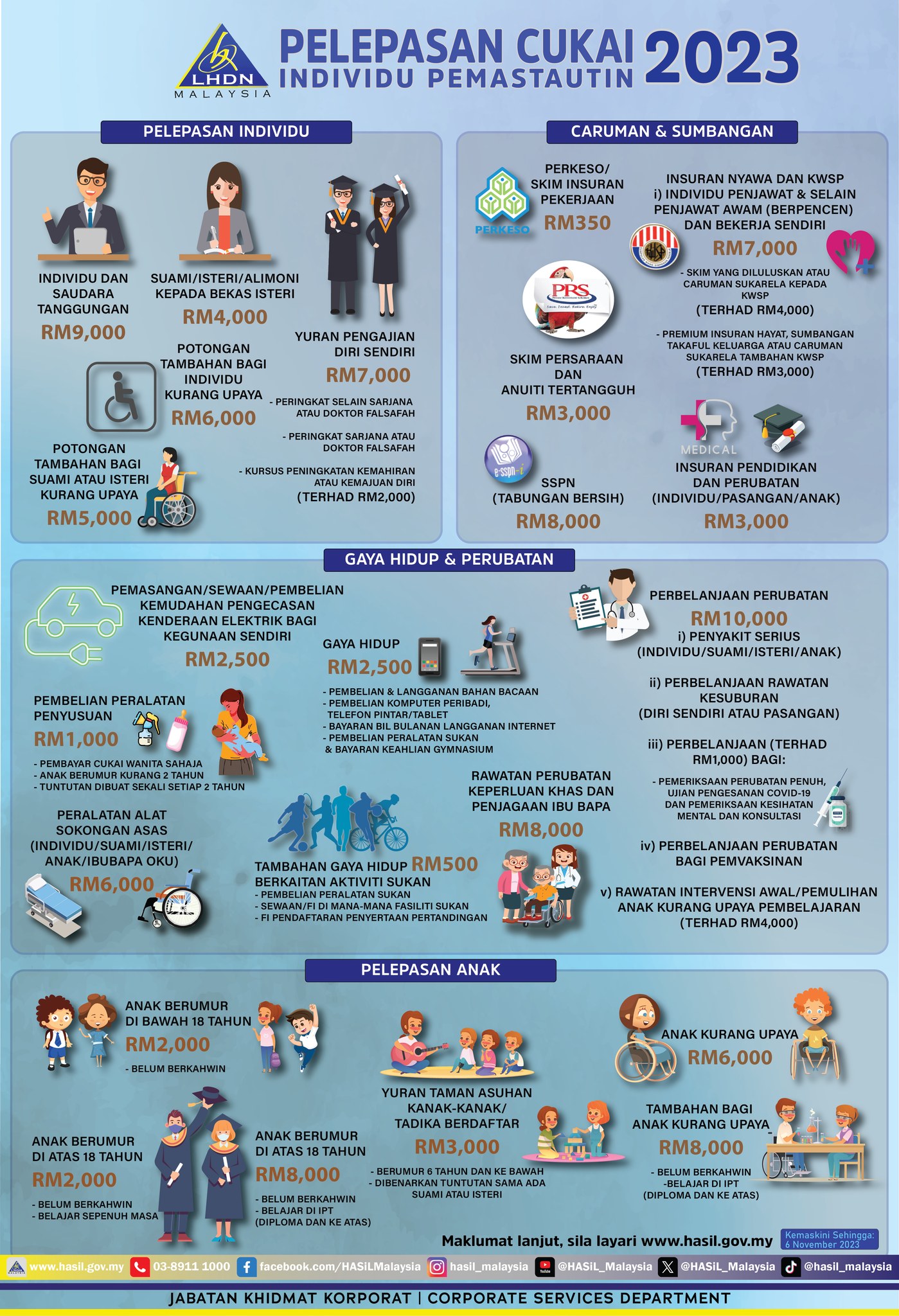

You can also check out this handy infographic by LHDN:

The deadline to file your income tax returns is 30 April 2024, and if you use e-filing services, there is a grace period of 15 days up to 15 May 2024.

Log in to LHDN's website MyTax to file your income tax returns.

For more information regarding income tax reliefs, you can visit the LHDN website, contact LHDN at +603-89111000, or visit any LHDN branch near you.