Get Financial Tips From Top M'sian CEOs, Side Income Ideas & More At This Virtual Event

From young adults wanting to grow wealth to parents looking to instil good money values in children, Financial Literary Month 2021 has got everyone covered. ;)

Let's face it, getting your finances in order is no easy feat, so when in doubt, it's best to seek help

The Internet provides good resources that you could turn to as a first step, but sometimes details can still get a little fuzzy and confusing.

Plus, with demanding lives, as well as uncertainties brought upon by the current worldwide predicament, it's harder to put into practice whatever good info that we've learned on our own.

Here is where a platform like Financial Education Network (FEN) — comprising eight institutions and agencies: Bank Negara Malaysia (BNM), Securities Commission Malaysia, Ministry of Education, Ministry of Higher Education, Employee Provident Fund, AKPK, Perbadanan Insurans Deposit Malaysia, and Permodalan Nasional Berhad — can offer support.

In conjunction with Financial Literacy Month 2021 (FLM 2021), FEN is hosting a slew of activities to help you better navigate your finances and make informed decisions when it comes to money

Returning virtually for a second year, this month-long event aims to provide the tools and information to help consumers achieve financial goals, manage debts, plus protect themselves from financial scams, especially in these challenging times.

This means you can look forward to comprehensive monetary advice from industry experts that will suit your needs, regardless of the phase of life you're in

Whether you're a college student looking for better ways to save, a young adult wanting to grow wealth, or even a parent who'd like to instil good money values in your child, FLM 2021 has got you sorted.

Here's what you can expect to get out of the virtual event:

1. Financial education support and intervention during challenging times

2. Avenues for financial consultation and redress

3. Learn and adopt responsible money management practices, including risk management like insurance protection, plus the options available to address your financial vulnerabilities

4. Gain information and access to alternative income-generating training and platforms, as well as upskilling and reskilling programmes

And the good news? You'll not only get to enjoy valuable tips and tools from industry experts and certified financial advisors, but also stand a chance to win e-vouchers up to RM80,000 by participating in virtual activities during the last leg of FLM 2021. :D

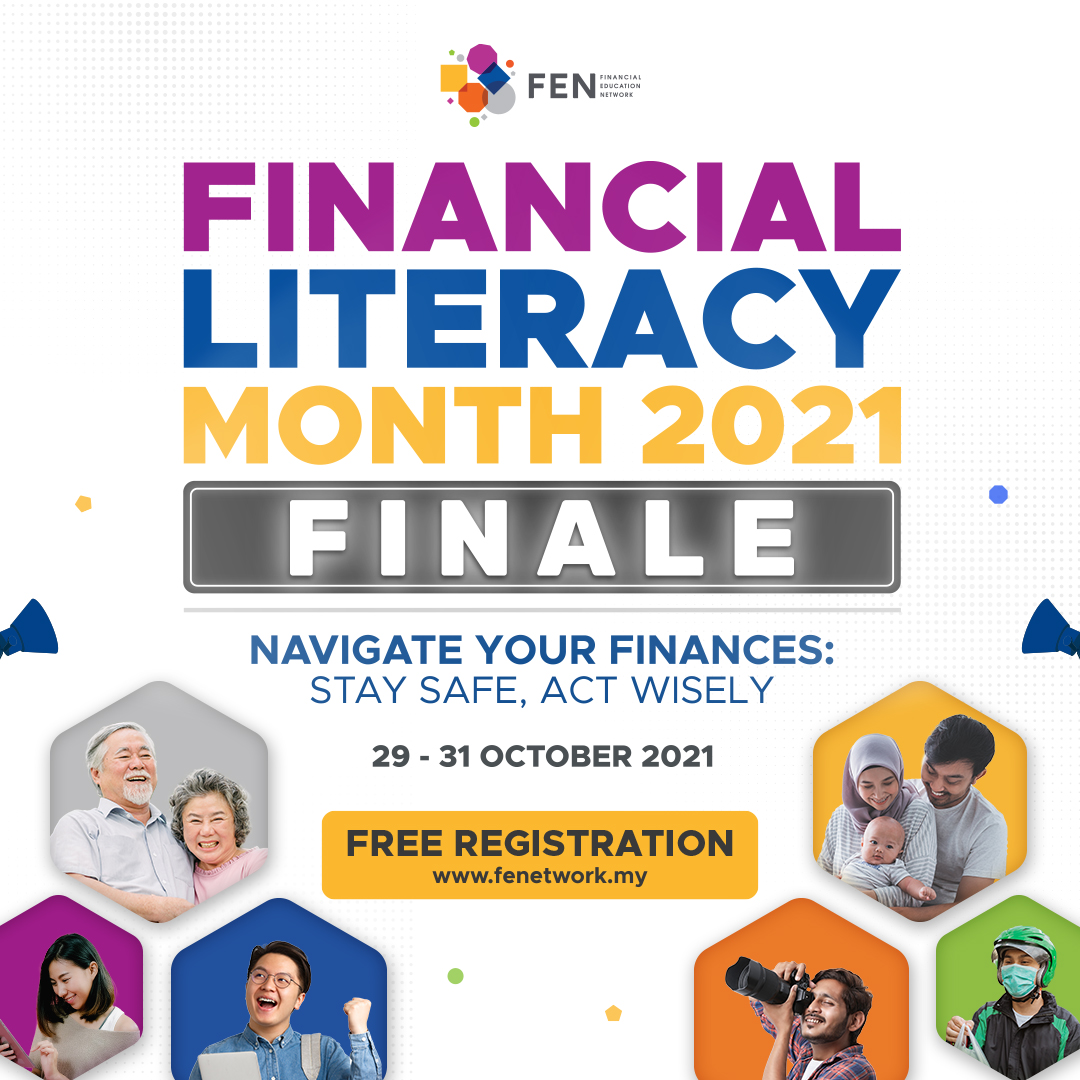

Themed 'Navigating Your Finances: Stay Safe, Act Wisely', here are highlights of the activities during the finale event from 29 until 31 October:

Virtual financial advisory clinic

- An event, called 'Meet Your Bank', comprising 22 banks under a one-stop virtual platform

- Helps affected borrowers to connect and virtually meet one-to-one with their banks for financial advisory and to discuss repayment assistance options in a safe and secure setting

Webinar series

- Educational webinars on the topic of personal financial management for youth, parents, families, adults, micro-SMEs, and gig workers

- Topics will cover insurance, income protection and how to generate side income, managing money and debt, insurance and Takaful protection, raising a financially literate family, and more

- Panellists for the webinars include industry experts such as CEO of Grab Malaysia, Sean Goh, CEO of RinggitPlus, Hann Liew, CEO of GoGet, Francesca Chia, and more

Virtual exhibitions

- Involves over 30 exhibitors made up of FEN members and strategic partners

- Get access to information and speak to designated staff on financial management, e-payment, insurance and Takaful, investment, financial fraud, and retirement planning

- Connect with government agencies and companies for skills upgrading, retraining and opportunities to generate income, with a focus on supporting gig workers, micro, small and medium enterprises (MSMEs), as well as those currently unemployed

Kids corner

- Financial education tailored for school children through fun online programmes, financial literacy activities, and quizzes in one channel

- Will also showcase a special virtual LATerasi Kewangan exhibition of Datuk Lat's caricature collection

Financial planning

- Free virtual consultation with licensed financial planners through one-on-one sessions with licensed financial planners

Financial crime exhibition

- To raise awareness on financial scam activities, especially about illegal money transactions through mule accounts (a bank account used to transfer illegal funds on behalf of others), and how the public can avoid becoming victims

So, if you're worried about insufficient funds for a rainy day, or not having enough savings for retirement, or would simply like to feel more secure about your banking solutions, the programmes are worth a look

When it comes to your finances, it's always a good idea to equip yourself with more knowledge, and the resources offered during FLM 2021 may very well give you the confidence to make better decisions too.

Plus, there's something for everyone to learn from — children, students, youths, adults, and retirees, as well as gig workers and micro-SMEs — guided by industry experts, no less. ;)

And don't forget, you may win lucky draw prizes up to RM80,000 too, woohoo! All you have to do is visit the different rooms and activities. Choose from webinars, exhibitions, as well as a dedicated kids corner, or schedule an appointment with banks or financial planners for your chance to score.

Interested to join this free event? Register to secure your spot today.

For more info, visit Financial Education Network's Facebook page or Instagram.