Citibank Offers Personal Loans With Low Interest Rates And No Processing Fees

You can even apply online for a Conditional Approval instantly!

Personal loans can be a great financial tool, but it's important to use them carefully

Above all, it's vital to only apply for a personal loan after doing thorough research, and when you are financially prepared.

Though personal loans usually have a lower interest rate than credit cards, you'll still have to make monthly instalment payments until the end of your loan period.

So, while it is tempting to take out a personal loan to fund that big, fancy wedding of your dreams or to make that big purchase you've been eyeing, you should carefully think about whether you're financially ready to take on that responsibility.

When used correctly, personal loans can be a huge help in many situations

This includes obtaining seed money to pursue your personal interests, investing in your future and personal growth by furthering your education, or if you need quick funds to manage an unexpected emergency.

In once-in-a-lifetime situations such as these, personal loans are a great option that allow you to quickly get the money you need at a lower interest rate.

Citibank offers personal loans with low interest rates and no processing fees. Plus, you can even apply online and enjoy Conditional Approval instantly!

With Citibank's personal loans, you can now better manage your expenses.

They offer a wide variety of plans, from small to big. Whether you just need a little bit extra to top off what you've already saved up or a full amount to cover something you have been planning for a long time, Citibank has got you covered. They offer personal loans from as low as RM5,000 and up to RM150,000.

The best thing about them is their affordable interest rates, lessening the financial burden of repaying the loan. Enjoy flat interest rates from as low as 5.88% p.a.

And when it comes to the monthly payments, Citibank has made it simple and easy. You can choose how long to repay the loan, from 24 months up to 60 months. This gives you better flexibility to plan out your finances and budget for the repayments.

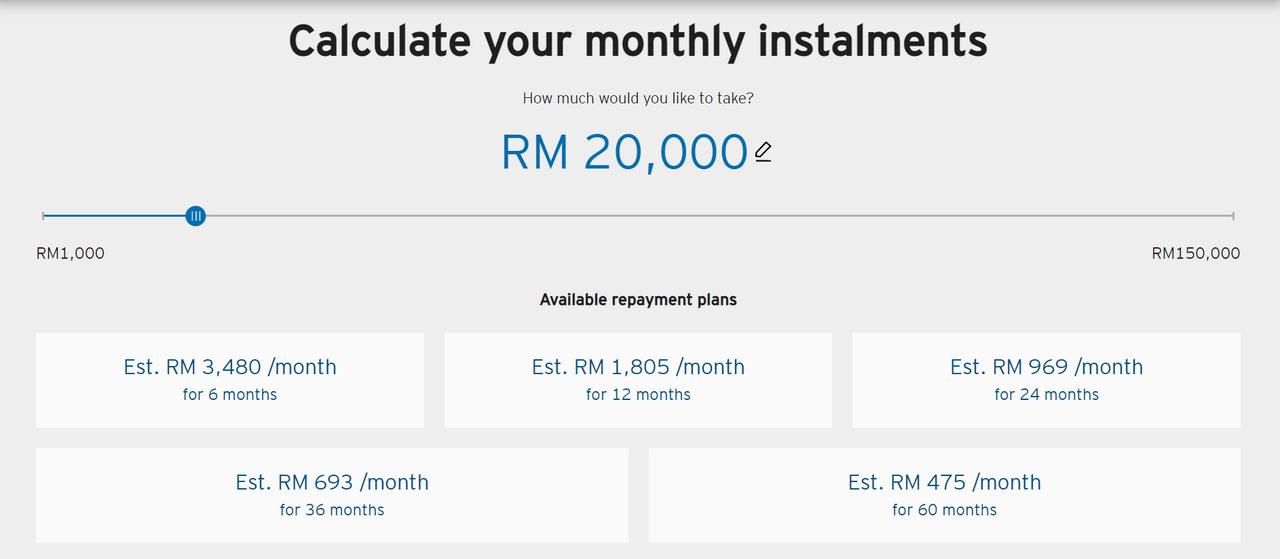

There's even a handy tool on their website that gives you a sneak peek at what your potential repayment plan could look like

Just drag the slider to the loan amount you want to take, and it'll automatically generate repayment plan options based on an Effective Interest Rate of 14.9% per annum. Your monthly instalments might be different, as your entitled interest rate and tenure is subject to eligibility.

However, this is still a great way to see what your potential monthly payments will look like, and it'll help you get started on planning your repayments.

For example, if you take a RM20,000 personal loan, here are your potential repayment plans:

- Est. RM3,480 /month for 6 months

- Est. RM1,805 /month for 12 months

- Est. RM969 /month for 24 months

- Est. RM693 /month for 36 months

- Est. RM475 /month for 60 months

Check out the calculator here to find a plan that suits your needs.